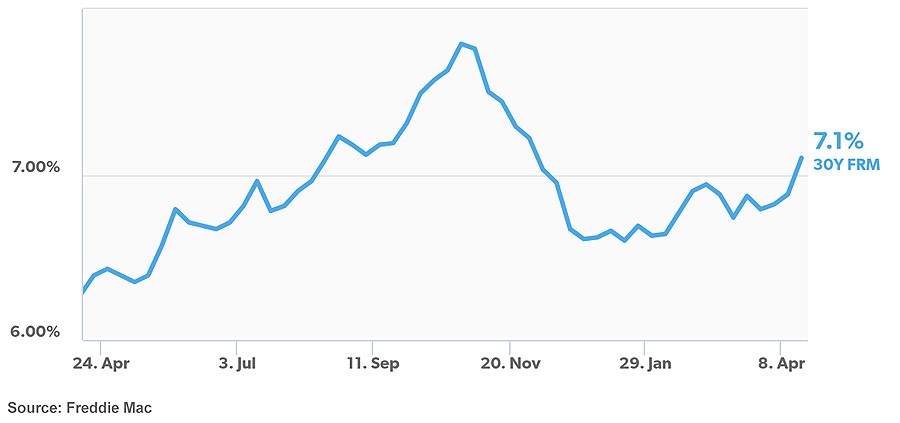

The average mortgage rate on a 30-year loan hit a record high for 2024, breaking through the 7% mark and settling in at 7.10%, as reported by Freddie Mac. This rise in rates has made homeownership out of reach for many, increasing the demand for rental properties across the board.

Mortgage rates have been gradually increasing over recent weeks, fueled by hotter-than-anticipated economic reports that effectively put the brakes on federal rate cuts happening anytime soon.

Odeta Kushi, deputy chief economist at First American, elaborates on this as she states, “Persistent inflation has dashed investor hopes for a Federal Reserve rate cut in June, which implies mortgage rates will remain higher-for-longer. If inflation data between now and May continues to come in hotter than expected, and/or the Fed takes on a more hawkish tone at their upcoming meeting, we can anticipate upward pressure on mortgage rates.”

Demand for Rental Properties Surges as Climbing Mortgage Rates Push Homeownership Further Away

With mortgage rates climbing week after week, slowing the housing market down, new residential construction starts and completions are down due to the decreased market activity. Along with this, current homeowners are more reluctant to sell while the rates are elevated. Both the reduction in building new homes and the lack of existing properties being listed for sale have created a dwindling inventory in the housing market. As a result, those homes that do appear on the market are met with heightened demand, thereby justifying a higher selling price and funneling families into rentals.

Related Article: Report States Renting More Affordable Than Buying Indicating Financial Security for Investors

Ben Ayers, nationwide senior economist, comments on this scenario that’s playing out, “Market conditions for homebuyers remain challenging with few homes listed and costs for ownership still climbing. Despite strong fundamentals for demand from demographics and a strong labor market, many first-time buyers are being shut out of the market by elevated financing rates and rising prices.”

Current Homeowners Cling to Locked-In Low Mortgage Rates Creating a High Renter Interest

According to a report from Realtor.com, the supply of available homes has experienced a dramatic decrease of 34.3% compared to the typical levels that were seen before the onset of the COVID-19 pandemic in early 2020. As it stands, nearly 80% of current mortgage borrowers benefit from interest rates lower than 5%.

Julia Fonseca, a professor at the University of Illinois at Urbana-Champaign, put it into perspective when she stated, “You could think of your locked-in rate as an asset that you own. It’s estimated that homeowners could see an estimated $50,000 in savings by sticking with their current mortgage rates.”

As mortgage rates continue on an upward trend, and sellers hold onto their properties, families seeking shelter look to renting, which has created a competitive rental market. Because of this, national vacancy rates are as low as 6.6%, as revealed in the U.S. Census Bureau’s fourth-quarter report released in January 2024.

Low vacancy rates and soaring demand for rental properties are leading to a shortage of available units and rising rental costs. While this scenario presents challenges for individuals in search of housing, landlords are experiencing the benefits of increased profits and consistent cash flow.

When Will Mortgage Rates Ease and Loosen the Tight Rental Market?

Should interest rates decrease, leading to more housing market activity and an increase in the availability of homes at more affordable prices, the rental market could loosen up. Analysts remain uncertain about the specific timeline for when this might all take place, but it’s anticipated that mortgage rates may decrease following the next Federal Open Market Committee’s decision to reduce the benchmark interest rate. However, should inflation continue to exceed the Fed’s targets, current rate levels are likely to be maintained.

Founder and CEO Rick Sharga of CJ Patrick Company, a market intelligence and business advisory firm in the real estate sector, touches on the timeframe, stating, “Momentum in the labor markets — lower unemployment and unexpectedly strong job creation — coupled with inflation that’s simply not moving in the direction the Federal Reserve wants, make it unlikely that we’ll see the Fed funds rate cut before June at the earliest.

That probably means that mortgage rates will stay at or slightly above 7% through May as the market bides its time. We’re not likely to see mortgage rates decline significantly until after the Fed makes its first cut; and the longer it takes for that to happen, the less likely it is that we’ll see rates much below 6.5% by the end of the year.”

Increased Rental Demand Signaling Hot Market for Landlords

With vacancy rates low and the demand for rental properties high, along with a housing market that’s not easing up anytime soon, landlords are presented with an ideal situation that can be financially rewarding.

Related Article: Mortgage Rates Rise in Response to Several Factors as Housing Activity Slows Creating Opportunity for Property Investors

Investing at this time is not only beneficial because of the surge in rental applications, but also because buying while housing activity is low allows investors to avoid competitive bidding wars that can significantly raise the purchase price. In addition to this, housing prices are expected to continue to rise, so getting in now before the cost to buy surges further is a smart financial move. Those concerned about the current high mortgage rates should know that they can always refinance later when the rates settle down.

Investors interested in adding rental real estate to their portfolio while there’s still a high demand for rental properties can contact Morris Invest, a full-service rental real estate company that offers a lower-than-industry standard mortgage rate for new construction properties, as well as bulk pricing that can lead to significant savings on the purchase price. You can also head over to the Morris Invest & SDIRA Program page for a full company overview.

In the meantime, be sure to watch the following video that touches on inflation, which can affect mortgage rates.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.