A Rental Affordability Report released this month by ATTOM, a provider of nationwide property data, concluded that in 90% of local markets across the U.S., medium three-bedroom rents are more affordable than owning a comparable home.

Even with renting coming out on top as the more affordable option, the data revealed that in a significant number of housing markets, renting and owning both created a financial burden on average workers, with the cost exhausting around one-third of their wages.

Although high rents are effectively placing a financial strain on tenants, the cost of renting still consumes a smaller portion of the average worker’s earnings, as compared to the substantial costs associated with homeownership. This scenario is pushing families away from home purchases and funneling them into rentals, creating a high demand for this housing type.

Rental Rates Outpacing Home Prices

Over the past year, rental rates in the U.S. have been increasing faster than home prices. This is due, in part, to the high demand for rentals as more people find homeownership beyond their financial reach. The limited supply of available homes is also contributing to this trend, leading even more people to rent a home.

Rob Barber, Chief Executive Officer of ATTOM, touches on this as he states, “Finding an affordable home remains a daunting prospect around the country for average workers, regardless of whether they want to buy or rent. Continuously increasing home prices contribute to the escalation of rental costs, making both buying and renting properties a challenging endeavor across most of the United States. But the latest data shows that even as rents are growing faster, they remain more affordable than owning.”

Related Article: The Driving Factors Behind the Ability to Charge Higher Rental Rates

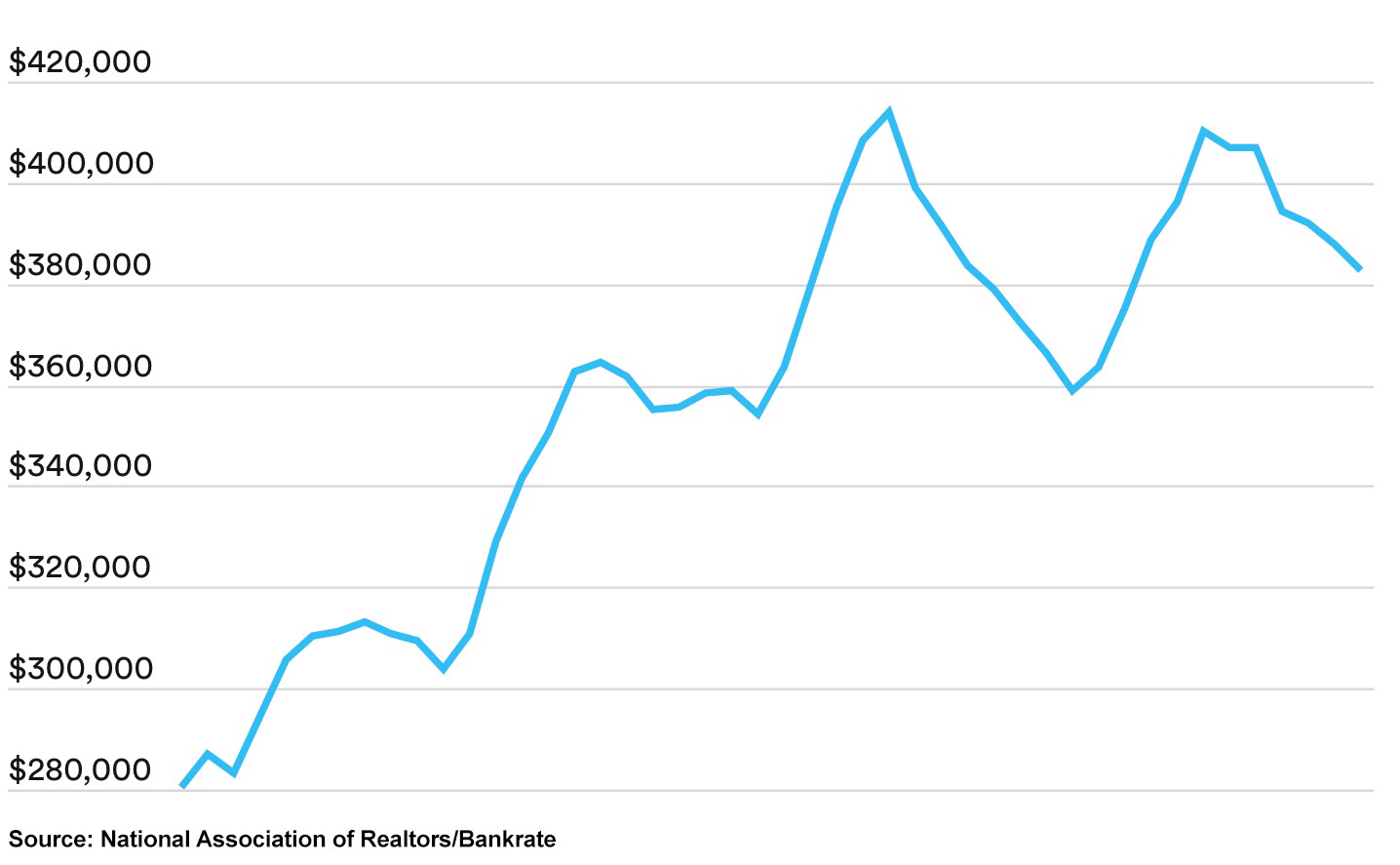

A variety of elements are coming together to create an unaffordable homeownership environment. This includes inflation and rising property prices, larger down payments, higher home insurance costs, and the like. Home prices have skyrocketed over the past few years, outpacing wages, and the data below gives a snapshot of how quickly these prices rose:

Medium Existing Home Prices: 3/2020–12/2023

High Demand and Surging Rental Rates Place Investors at a Financial Advantage

In today’s market, where interest rates are dropping, housing prices are on the rise, and rental rates are climbing even more rapidly yet remaining less expensive than ownership, real estate investors are presented with a unique advantage. They have the opportunity to secure elevated rent prices, setting themselves up for a profitable and secure income stream.

Along with this, the current housing market enables investors to capture significant equity if they buy before the prices are predicted to rise even more in the coming months. That said, investors who hesitate to buy now at a lower cost will miss out on these potential equity gains.

Related Article: Investors Buy to Secure Equity as Home Prices Continue to Rise

In addition to this, if a property is purchased after the prices rise, then the elevated rents that we’re currently seeing will be a wash because they’ll be offset by the higher monthly mortgage costs.

Secure a Cash Flowing Rental Property Before the Next Surge in Housing Prices Hits

If you’d like to create streams of income so you won’t have to rely on your current employer for financial security, or you’re looking for a smart way to save for retirement, or perhaps you would just like to add to your current portfolio, now is the time to jump into the market. Housing prices have been on a steady rise, so even waiting a month or two can negatively impact your return on investment.

If you’re leaning towards investing now but unsure how to buy before the next wave of price hikes occurs, know that Morris Invest can take care of everything for you. It’s what we do on a daily basis, and we can certainly make it happen for you.

To give you an idea of what our full-service real estate investing company can provide, take a look at the information below:

- Conduct extensive market research to make sure your rental property is built in an area that will allow it to generate maximum cash flow.

- We provide free consultations on funding strategies that work with your particular financial situation, such as borrowing from your 401(k), investing with a self directed IRA, and more. Please see our article titled – Why the 401(k) is a Bad Investment Vehicle to Retire On if you’re feeling uncomfortable about touching your retirement account.

- Our team negotiates the lowest rates possible with more than 200 lenders to get our clients the best possible deal.

- We offer build-to-rent, new construction properties with the option to own single-family and multi-family duplexes.

- Our company builds a new construction cost segregation analysis into each property, allowing the investor to save thousands in taxes. You can read more about this by heading over to our article on the topic – Is a Cost Segregation Study Worth it?

- Help with incorporating to optimize tax advantages and safeguard against potential liabilities.

- Morris Invest assigns an experienced property manager to each rental so the property and the tenants are cared for – they collect the rent for you and handle those unexpected repair calls that may come in the middle of the night.

- You won’t have to search for a tenant because we place one for you, typically before or during closing – in most cases, this allows for immediate cash flow.

- The team over at Morris Invest is here for you before, during, and after the property purchase.

Power Resources for Investors

You can increase your investment knowledge base by heading over to the following financial resources – they can change your life by placing you in the driver’s seat when it comes to your financial growth.

- The Financial Freedom Academy

- Freedom Number Cheat Sheet

- 90-Day Financial Empowerment Bootcamp

- Morris Invest & SDIRA Program Overview

Don’t miss out on the opportunity to buy during a time when investors have the upper hand. Schedule a complimentary call and let our team guide you into becoming financially independent through real estate investing.

Grab a cup of coffee and dive into the following video that offers invaluable insights into how to get started investing in rental properties:

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.