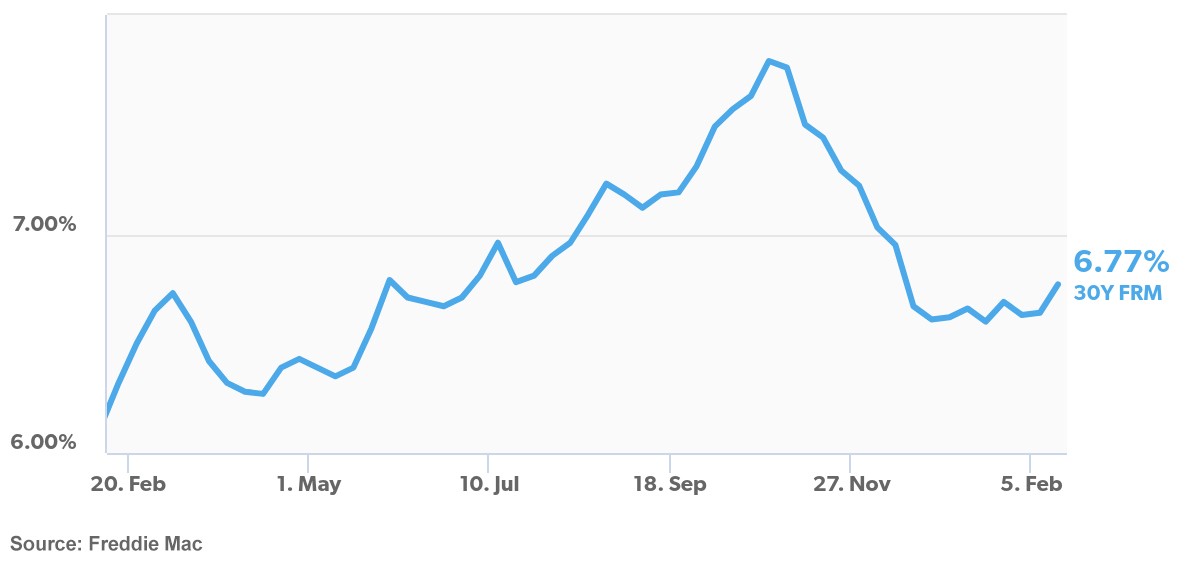

The average long-term U.S. mortgage rate rose last week to its highest point in 10 weeks, adding to the list of closely watched economic data released just days apart.

According to Freddie Mac, the 30-year fixed-rate mortgage experienced an increase of 13 basis points over the previous week, climbing to 6.77% for the week ending February 15th, up from 6.64%. This was the first time since mid-December that the average mortgage rates rose above the 6.7% threshold, a reaction triggered by a combination of factors, including the most recent CPI inflation report that came in at 3.1%.

Mortgage Rates Climb as CPI Data Influence a Spike in Treasury Yields

The CPI figures were higher than anticipated, which sent shockwaves through the stock market, pushing U.S. Treasury yields up that same day. The 10-year Treasury yield is generally a reference point for fixed-rate mortgages, as mortgage lenders typically use Treasury yields as a basis for setting their own rates, so this rise directly translated to higher mortgage rates.

Incorporating the PPI and Jobless Claims into the Equation

Just days after the CPI numbers were released, financial markets were rattled once more by the Producer Price Index (PPI). The report issued on the 16th showed a rise of 0.3% in wholesale prices for January, surpassing the 0.1% increase forecasted by analysts. This, in turn, created an additional surge in Treasury yields that same day. Consequently, this yield increase caused another uptick in mortgage rates, as revealed in data from Mortgage News Daily’s 30-Year Fixed mortgage rate survey, which indicated a growth from 7.03% to 7.14%.

Adding to the mix, the February 15th weekly jobless claims came in as lower and better than expected, reporting 212,000 initial jobless claims, which represented a decrease of 8,000 compared to the previous week. Jobless claims refer to the number of people who applied for unemployment insurance for the first time, signaling they have recently lost their jobs. This metric is a critical economic indicator, as it sheds some light on the health of the employment sector and the economy as a whole.

Although the weekly jobless claim reports don’t always have an immediate impact on rates, lower claim numbers have been associated with higher interest and mortgage rates. This is the case because when jobless claims are low, it indicates that more people are employed and the economy is performing well. In such scenarios, consumer spending typically increases, possibly leading to inflation. Because of this, the Federal Reserve may raise interest rates to keep inflation in check, as higher borrowing costs tend to cool down an overheated economy by pushing down spending.

Rising Mortgage Rates Lead to Decreased Housing Market Activity

With a mixed bag of recent reports pushing mortgage rates up, there’s been a new level of doubt among prospective homebuyers who had plans to enter the spring buying season, causing some to defer their purchasing plans in anticipation of more favorable rates.

Bright MLS Chief Economist Lisa Sturtevant touches on this as she states, “Waiting for rates to fall further later this year could make sense for some buyers. However, inventory will remain tight and prices will continue to rise in most local markets. As a result, some buyers may find it makes sense to act now if they find a home that meets their needs.”

It’s clear to analysts that this rise in mortgage rates is a response to short-term factors, and that they will fall back down. Potential homebuyers are holding on to this prediction and riding out the storm, waiting for another break in rates before they jump into the market. This all equates to a pause in the momentum that was building up to the spring buying season.

Investors Advised to Buy During the Lull in Housing Activity

We’re seeing mortgage demand dropping at this time as buyers, as well as sellers, hold off for better rates. Sam Khater, Freddie Mac’s Chief Economist, comments on this, saying, “On the heels of consumer prices rising more than expected, mortgage rates increased this week. The economy has been performing well so far this year and rates may stay higher for longer, potentially slowing the spring homebuying season. According to our data, mortgage applications to buy a home so far in 2024 are down in more than half of all states compared to a year earlier.”

This lull in activity opens a window of opportunity for real estate investors to get ahead of the game by purchasing now. Buying soon will enable investors to make offers without as much competition that brings about bidding wars. Additionally, it offers the chance to invest before the next drop in interest rates, which is anticipated to drive property prices higher. If buying before there is a drop in rates goes against what you were taught, know that you can always refinance and change the interest rate later down the line when rates drop even further – what matters most is saving thousands of dollars on a property you were able to buy at a lower price.

If you’d like to jump on this window of opportunity but you’re unsure how to even get started, Morris Invest can make it happen for you. Our team can provide you with a cash flowing new construction single-family or multi-family duplex, where we place a reliable tenant for you, as well as assign an experienced property manager.

Morris Invest can take care of every detail from start to finish to make a property purchase happen during this time. However, it all starts with you taking the first step by scheduling a complimentary 30-minute call, and we can take it from there. We would love to speak with you, hear all about your investing goals, and create a custom plan that will place a lucrative rental property in your hands before the market is flooded with buyers. If you’d like to get an idea of the locations we build in, then be sure to head over to our article titled – What Makes Rental Real Estate in Texas Profitable?

Power Resources for Property Investors

Whether you decide to invest at this time or not, we suggest diving into these popular resources that will set you on the path to becoming financially independent through real estate investing.

- The Financial Freedom Academy

- Freedom Number Cheat Sheet

- 90-Day Financial Empowerment Bootcamp

- Morris Invest & SDIRA Program Overview

Don’t hesitate to reach out to Morris Invest. We can help you achieve your dream of owning a rental property that generates monthly cash flow; it’s what we do best.

Before you go, take a moment to jump into the following video for an in-depth look at how investors save a considerable amount of money when working with a full-service investment company:

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.