The recent Consumer Price Index (CPI) report, released this week by the Bureau of Labor Statistics, came in hotter than anticipated, impacting mortgage rates and effectively casting a shadow on the spring buying season.

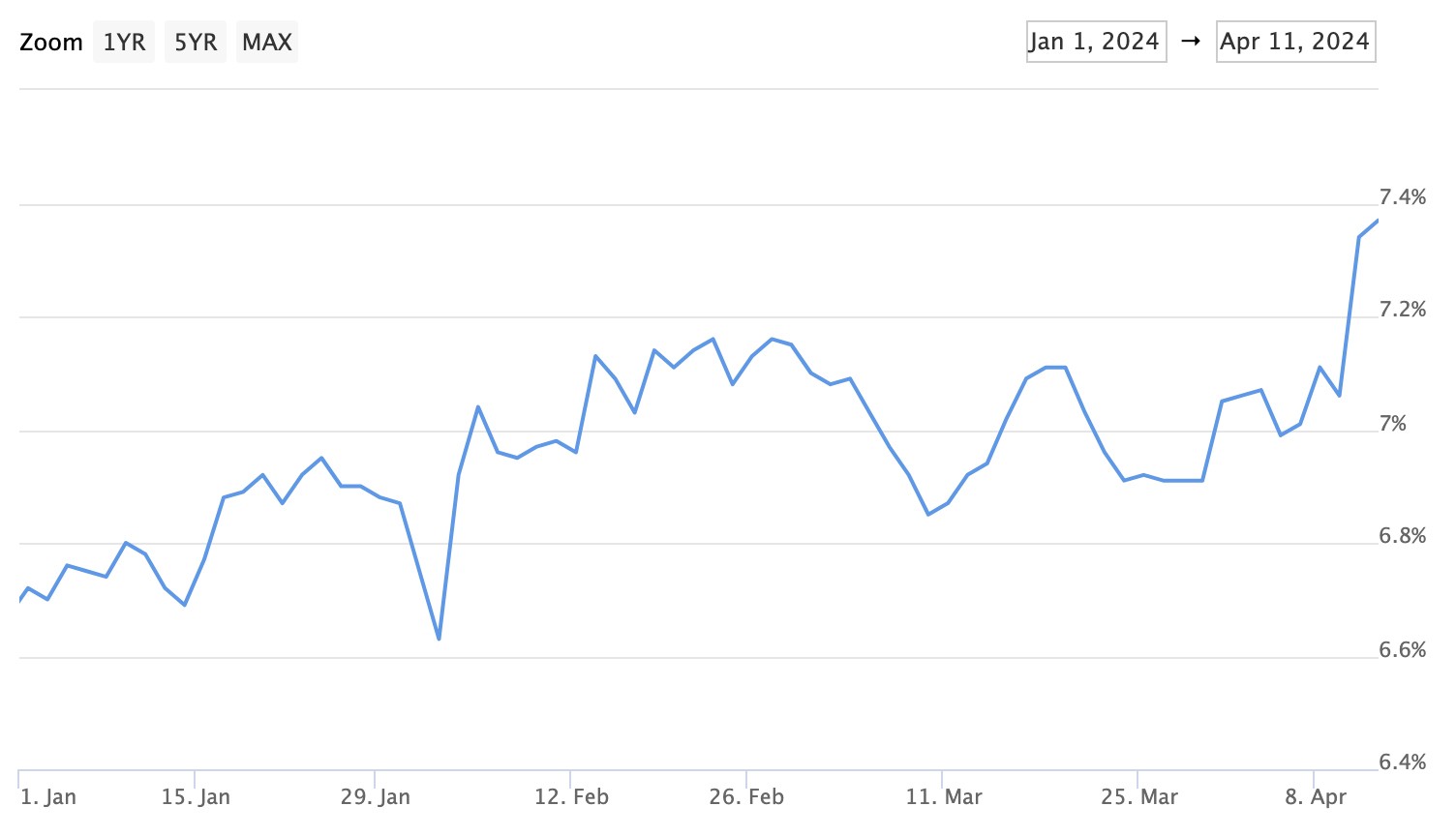

The data revealed a 0.4% increase, landing at 3.5%, up from February’s rate of 3.2%. In the wake of this announcement, mortgage rates climbed from 7.06% the day prior, to the current rate of 7.37%, as reported by Mortgage News Daily.

The new inflation numbers are keeping prospective homebuyers in a holding pattern that they were hoping to break out of. In addition, with inflation rates exceeding projections once again, the outlook for lower mortgage rates and the ability to move forward on property purchases seems a distant reality for many.

This outlook is reflected in a statement released by Redfin: “Today’s data and the implications for the Fed will almost certainly keep mortgage rates elevated in the near term. Absent new economic data that would allow the Fed to cut sooner, homebuyers and sellers may not see much, if any, relief through the traditional peak homebuying season.”

30-Year Fixed Mortgage Rates – January 1 thru April 11, 2024

Outlook on Lowering Mortgage Rates Dims as Interest Rate Cuts Are Dismissed

Despite the March Producer Price Index (PPI) coming in lower than expected, attention remains primarily on CPI figures, which highlights the reality that interest rate reductions are no longer on the table in the next few months. This is noted by Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, “For those hoping for six rate cuts this year, that ship has sailed; and now the question is whether or not we will even get the three rate cuts that many believed was possible as recently as the end of Q1.”

The CME FedWatch Tool, an online platform monitoring the likelihood of Federal Reserve policy changes, indicates a shift in market forecasts toward expecting the next rate cut to be in September, a delay from the previously anticipated June. This adjusted timeline shifts possible increased property purchases to the fall season, a time traditionally recognized for its slower market pace.

Fear of Postponed Rate Cuts Impacts Wall Street

This shift in rate cut expectations led to a sharp decline in stock futures, highlighted by the Dow Jones Industrial Average dropping by 422.16 points. The CPI data also prompted a rise in U.S. government bond yields, with the benchmark 10-year Treasury note reaching 4.5% for the first time since November. The impact was also felt across major indexes, with declines in the S&P 500 and the Nasdaq Composite, underscoring the market’s sensitivity to inflation dynamics. This, in turn, impacted 401(k) holders who have their wealth directly tied to Wall Street and the economy.

Related Article: Reasons Why the 401(k) is a Bad Investment Vehicle to Retire On

Investors Find Profit Potential in the Stagnant Housing Market

Seasoned real estate investors are capitalizing on the fact that the market has slowed down by acquiring properties in anticipation of future price hikes. This strategic move enables them to sidestep the pitfalls of bidding wars by securing properties before the market floods when rates finally do come down. This also promises the added advantage of accruing equity as property values continue to climb during the current housing shortage.

Related Article: Investors Buy to Secure Equity as Home Prices Continue to Rise

If you’re thinking about taking your wealth out of investments that rely on Wall Street and the volatile economy, real estate is a smart alternative. Morris Invest offers new construction real estate investment opportunities that can shield your wealth from inflation and other unstable economic factors. This is a wise approach because rental properties maintain their worth and consistently yield profits, regardless of fluctuations in the market or economic downturns.

If the stock market’s instability has you looking for other options, we invite you to book a complimentary 30-minute consultation with Morris Invest, or feel free to visit our program overview page for more information.

Take a moment to view the following video related to mortgages – Should You Pay Off Your Mortgage or Invest?

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.