In the first monetary policy meeting of 2024, the Federal Reserve announced it will hold its benchmark interest rate at 5.25 to 5.50 percent, marking the fourth consecutive session in which the rate has remained unchanged.

Drawing conclusions from the housing market’s response to the prior FOMC meeting, which resulted in an identical rate, this week’s announcement has pushed real estate investors to strategically move forward on property purchases to capture lower pricing.

The Fed’s decision to maintain current interest rates aligned with forecasts made by those closely monitoring economic trends. LendingTree’s Senior Economist Jacob Channel is one such person who had stated before the meeting commenced, “The Fed is being very cautious as it navigates the potential for future rate cuts. While it doesn’t want to leave rates high forever, it also doesn’t want to cut them prematurely and risk inflation spiking again.”

Other predictions include the first rate cut taking place this March during the Fed’s next meeting. This forecast was concluded by a FactSet poll where 4 out of 10 economists were in agreement.

Their insight may be off, though, as Powell commented on the subject yesterday, “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting.” Powell did, however, state that although unlikely, a March rate cut hasn’t been ruled out.

Mortgage Rates Still Expected to Trend Downward

While the interest rates remain unchanged, mortgage rates are still expected to drop, whether in March or shortly after. Channel of Lending Tree chimes in on this as well, “Even though the Fed hasn’t made any cuts, mortgage rates on 30-year, fixed mortgages are, on average, more than a percentage point lower now than they were in late October of 2023. This means we could see mortgage rates noticeably change while the Fed holds its target rate steady.”

Because there’s been no interest rate hikes recently, and analysts are projecting further dips in mortgage costs this year, we’re seeing a noticeable upswing in housing activity. This comes after a long period of dormancy that was put into effect by soaring mortgage rates.

Now, with mortgage rates looking even more promising after the FOMC’s rate meeting yesterday, a significant surge in housing activity is expected to take place this spring, driving pent-up buyers and sellers out of the woodwork.

Current Housing Shortage Coupled with High Demand and Escalating Prices

An active market sounds attractive; however, when the current insufficient housing supply and rising home costs are factored in, it’s considered troublesome for real estate investors who anticipate purchasing a rental property this spring or in the months to follow.

The housing supply is not where it should be, and researchers have reported that if home construction increases in 2024, there will still be a significant deficit of 1.5 million to 2 million.

This is reflected in single-family housing numbers, notes Odeta Kushi, Deputy Chief Economist at First American, when she stated, “While single-family housing starts have steadily increased throughout 2023, it will take years of accelerated new home construction to narrow the supply shortage gap from more than a decade of underbuilding”.

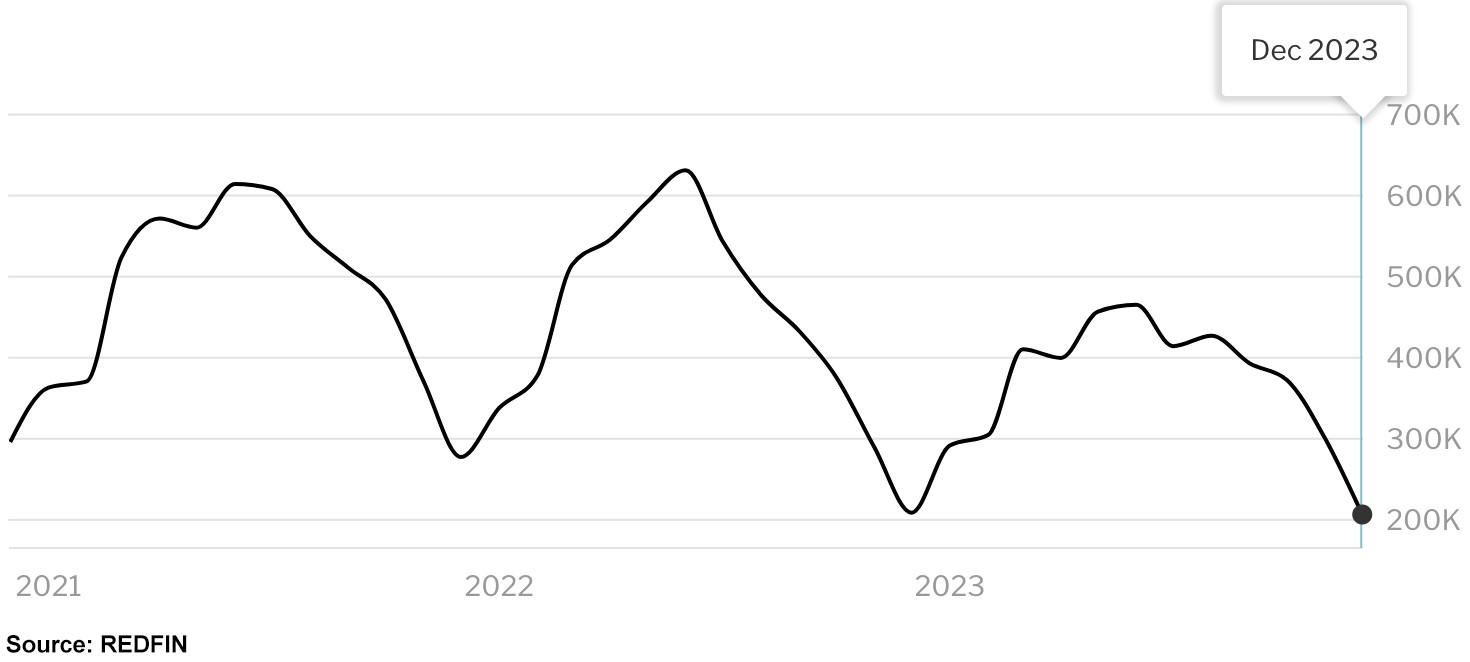

Along with this, single-family dwelling listings, in general, are keeping a low profile, as seen below:

U.S. Housing Supply – Number of Newly Listed Single-Family Homes

Invest Before Prices Spike and Competitive Bidding Wars Begin

A low housing supply and high demand such as this are pushing up home prices, and this can present a significant hurdle for real estate investors as the spring season draws near. Those who put off buying will suffer from a lower-than-anticipated ROI, especially when competitive bidding scenarios drive the costs upward even more.

For those investors who are on the fence about moving forward on a purchase, keep in mind that with each passing day, the cost of hesitation could translate into a higher price tag and lost equity.

In contrast, buying before the market floods with buyers sifting through what properties are left and dueling over them, is a wise strategic move that will set you on a path to securing a lower property price, increasing your profits, and capturing equity in the process.

Those who would like to read more about gaining equity in today’s housing market can head over to our article on the topic, Investors Buy to Secure Equity as Home Prices Continue to Rise.

Morris Invest Offers New Construction Rental Properties with Built-In Financing

Morris Invest can help you purchase a rental property before the market becomes more competitive this spring, and we encourage you to start the process soon, even if you lack the proper investment knowledge or experience. Our team of professionals can take care of all the details for you, allowing you to learn from the process. This will put a cash flowing property in your hands at the right time, all while you gain practical investment experience.

If you’re having problems getting started due to financial reasons, we can assist you with that, too. Our team is well-versed in locating funding for investors through traditional methods and more creative options. We also offer built-in financing with exceptional rates, which makes a big difference in the end.

Power Resources for Real Estate Investors

If you feel you’re not where you would like to be financially, explore the resources below to gain some insight into how to get to the next level – they can set you on the path to becoming financially independent.

- The Financial Freedom Academy

- Freedom Number Cheat Sheet

- 90-Day Financial Empowerment Bootcamp

- Morris Invest & SDIRA Program Overview

Feel free to schedule a complimentary 30-minute call so we can walk you through the process, discuss funding options, and explain how you can make a property purchase happen before bidding wars begin and prices rise again.

Take a moment to dive into the following video, which provides valuable information on ways you can get started investing so you’re ahead of the game, as well as details on real estate vs precious metals, and more.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.