The Federal Open Market Committee (FOMC) held its 2-day meeting this week, resulting in the key interest rate being left unchanged for a third consecutive time. As it stands, the benchmark federal funds rate is settled at 5.25- 5.5%, a 22-year high that has pushed borrowing costs up substantially.

Although this elevated number may sound unfavorable, the fact that the rates have not been pushed up at this point signals the Feds have most likely ended their rate hikes, which will pave the way for much-needed 2024 rate cuts. These new economic projections shine a hopeful light on mortgage rates that buyers and sellers alike have been watching closely.

Many economists agree that the path interest rates are currently on will positively impact the housing industry. Mike Fratantoni, Chief Economist and Senior Vice President of the Mortgage Bankers Association, touches on this as he comments, “Additional rate hikes no longer appear to be part of the conversation. It is all about the pace of cuts from here.” He goes on to say, “This is good news for the housing and mortgage markets. We expect that this path for monetary policy should support further declines in mortgage rates, just in time for the spring housing market.”

A Mortgage Rate Drop Occurs Only One Day After the Feds Meet

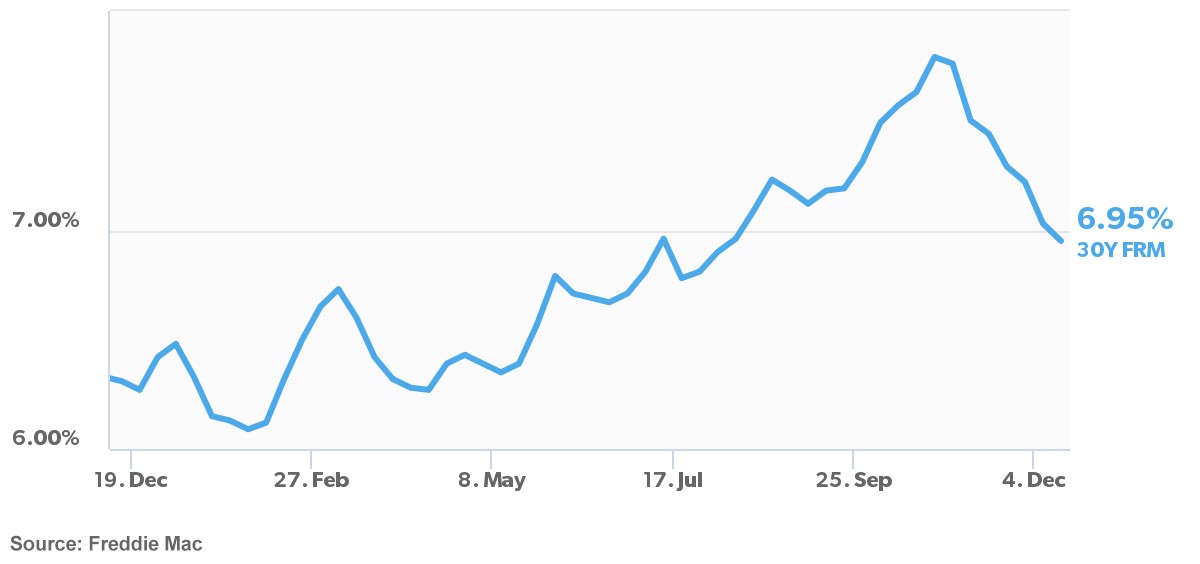

Following news from the Feds that its policymakers projected cutting the benchmark rate by 0.75% points by the end of 2024, mortgage rates dropped below seven percent for the first time since August. Freddie Mac reported the 30-year fixed-rate mortgage drop at 6.95% today, down from 7.03% last week.

U.S Weekly Average Mortgage Rates as of 12/14/2023

The plan to not raise interest rates is already having a favorable impact on the economy, most notably on the housing market, which has been paralyzed due to rate hikes that have occurred 11 times since March of 2022.

However, although the housing market is looking bright, there are still some issues to deal with, such as the pent-up demand for home purchases combined with the current housing shortage. Greg McBride, chief financial analyst at Bankrate.com, sums this up as he states, “A decline below the 7% threshold may trigger some additional demand among prospective home buyers. But it won’t move the needle on supply — at least not right away — so the frustrations about high home prices and limited selection will persist.”

A Massive Wave of Buying and Selling is Predicted Spring 2024

With key interest rates paused and rate cuts said to be on the way, a burst in the housing market is projected to start in the spring of 2024. April-September is considered a peak moving season, with 80% of moves occurring during these particular months. Parents getting situated before the new school year, and better weather for relocating play a large part in this.

Buyers will flood the housing market during this time, sifting through high-priced, limited inventory. As reported by Freddie Mac, housing inventory decreased by 5.4% in September from the previous year, so it’s predicted that it will become a considerable challenge for buyers when the floodgates finally open up.

Seasoned Real Estate Investors are Buying Despite Higher Interest Rates

Rates are lower but still at record highs, prompting some investors to hold off purchasing a rental property until the rates come down further, possibly this coming spring or summer. In theory, waiting may sound like a good move, but it poses a significant problem. Holding off until rates come down places the investor in the same arena as the multitude of homebuyers who will be desperately seeking out a piece of property simultaneously.

Those who have been in the industry long enough know that you don’t always buy based on the interest rate; you buy when the price is right – you can simply change the rate later, but you can’t change the cost of the property. Waiting until the rates are lower would be a bad investment strategy during the current housing climate, where bidding wars will be sure to take place on already overpriced properties.

A Full-Service Real Estate Company Will Place You Ahead of the Game

Buying now puts investors ahead of the game and places a lucrative rental property in their portfolio. If you’d like to be one step ahead of the thousands of home buyers that will be unleashed this spring, Morris Invest can help.

We specialize in assisting investors of all levels – from those just beginning their journey to seasoned professionals, in becoming financially secure through real estate investing.

Morris Invest sets investors up with new construction rental properties that are fully done for you; we take care of all the details, big and small, and work with over 200 banks to help you finance the purchase.

Related Article: The Power of a New Construction Cost Segregation Study Can Save You Thousands

Reach out to our team at Morris Invest to schedule a free consultation. We would love to hear about your investing and financial goals to help you get on track for building great wealth. We also invite you to review our Morris Invest & SDIRA Program Overview page, which provides quality information for all investing levels.

Sit back and dive into this related video that dives even deeper into why real estate investors shouldn’t wait for interest rates to drop before they buy a rental property:

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.