Investors were hit as stocks took a nosedive on Thursday, reacting to the latest figures from the U.S. Gross Domestic Product (GDP), which saw a growth of just 1.6% in the first quarter, falling short of economists’ expectations of a 2.4% increase, as polled by Dow Jones. This highlighted a concerning deceleration in growth and ongoing inflation concerns that affected major markets.

The Dow Jones Industrial Average was down 663 points, with notable downturns in shares of Caterpillar and IBM contributing to the decline. Meanwhile, the S&P 500 and the Nasdaq Composite experienced decreases as well.

As the stock market shifted downward, bond values rose, with the yield on the 10-year Treasury note reaching 4.722% at one point, its highest mark since November.

Senior Economist at Interactive Brokers, José Torres, states in a note to clients, “Treasury yields are soaring to their loftiest levels of the year on the back of this morning’s GDP report, which depicted slowing economic growth amidst accelerating price pressures. The stagflationary combination is particularly troublesome for stocks, whose fundamental prospects are generally driven by a robust economy while their relative valuations are tied to rates.”

Economy Grew at its Slowest Pace in Nearly Two Years

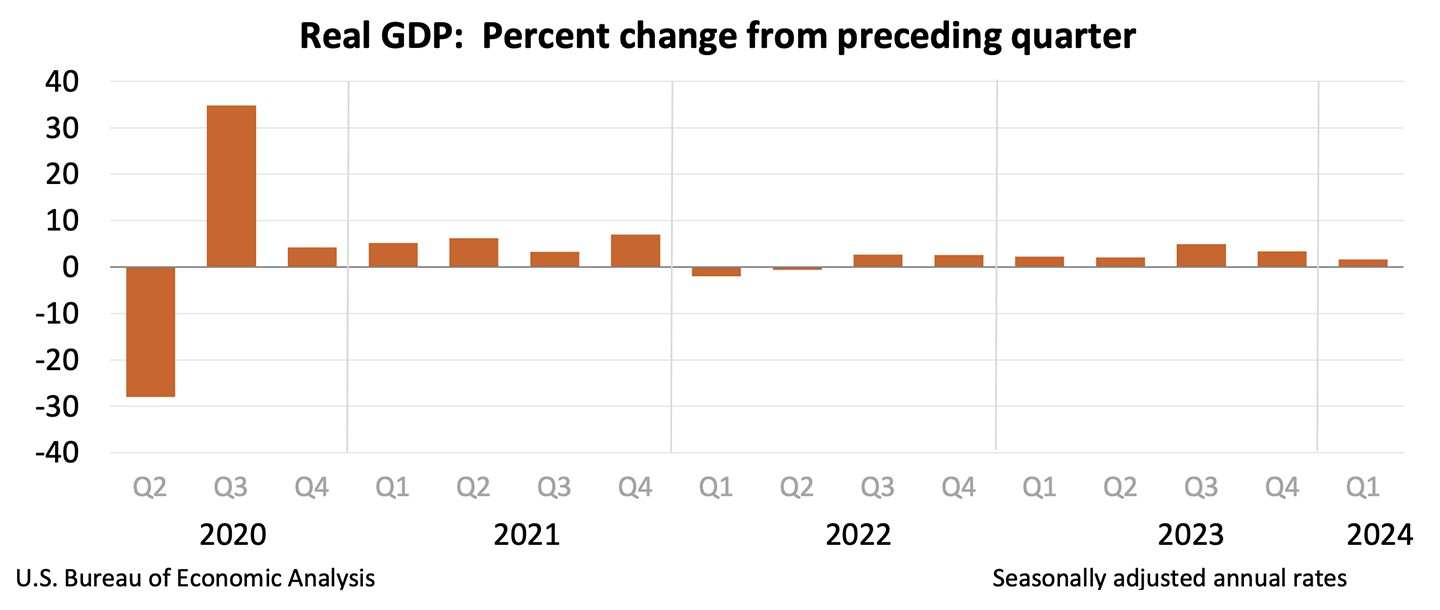

From January to March 2024, the economy only grew by 1.6%, which is much slower than the 4.1% growth in the last half of the previous year. This is the smallest increase since spring 2022. In addition to the quarter’s slow growth, the report indicated a significant uptick in consumer prices, rising at a 3.4% rate compared to the prior quarter’s 1.8% increase.

These numbers have sparked worries about ongoing inflation, casting doubt on the Federal Reserve’s ability to lower interest rates in the near future.

Related Article: Why Rental Properties are a Safe Investment During Times of High Inflation

401(k)s are at the Mercy of Economic Reports that Tank Wall Street

Economic reports influence both direct stock market investors and those indirectly connected through their 401(k) or other retirement funds. While positive economic trends can benefit these individuals, recent times have seen less favorable conditions, with economists unable to forecast a turnaround.

Individuals saving for retirement through a 401(k) face the potential of significant losses in their savings, not only due to the impact of inflation, GDP, and CPI report releases but also by unexpected economic downturns.

Related Article: Reasons Why the 401(k) is a Bad Investment Vehicle to Retire On

This was the case during the peak of the pandemic. At this time, individuals planning to retire that year who faced substantial financial losses within their 401(k) accounts were forced to postpone retirement and continue working. Add this to the fact that the average account is only around $112,000, then minus taxes, massive account fees, and factor in inflation, and you’re left with an amount that may only last two years after retirement.

The bottom line is that when placing your wealth in a 401(k) account, you risk losing it in the blink of an eye.

Investing in an Asset that’s Not Tied to Wall Street

An alternative to stock-based paper assets would be tangible assets such as rental real estate, or even gold. Real estate investments provide stability during economic downturns, substantial tax advantages, equity growth that can be used to buy additional properties, a high ROI, and steady monthly cash flow.

Those who would like to take their money out of their unstable 401(k), but are not sure how, can get started with the following information – If your 401(k) is tied to your current employer and you’re under the age of 59 1/2, borrowing against it might be your best option, allowing you to take out a loan against your account, with the interest paid right back into your 401(k). The maximum that can be borrowed is typically $50,000 and can be used as a downpayment for a rental property.

For 401(k)s not tied to current employment, rolling over your funds into a Self-Directed Individual Retirement Account (SDIRA) is a great strategy. This move opens up investment possibilities beyond traditional stocks and bonds.

Feel free to schedule a call with Morris Invest if you’d like to learn more about self directed IRAs, transitioning your 401(k) funds, or to hear about our build-to-rent properties.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.