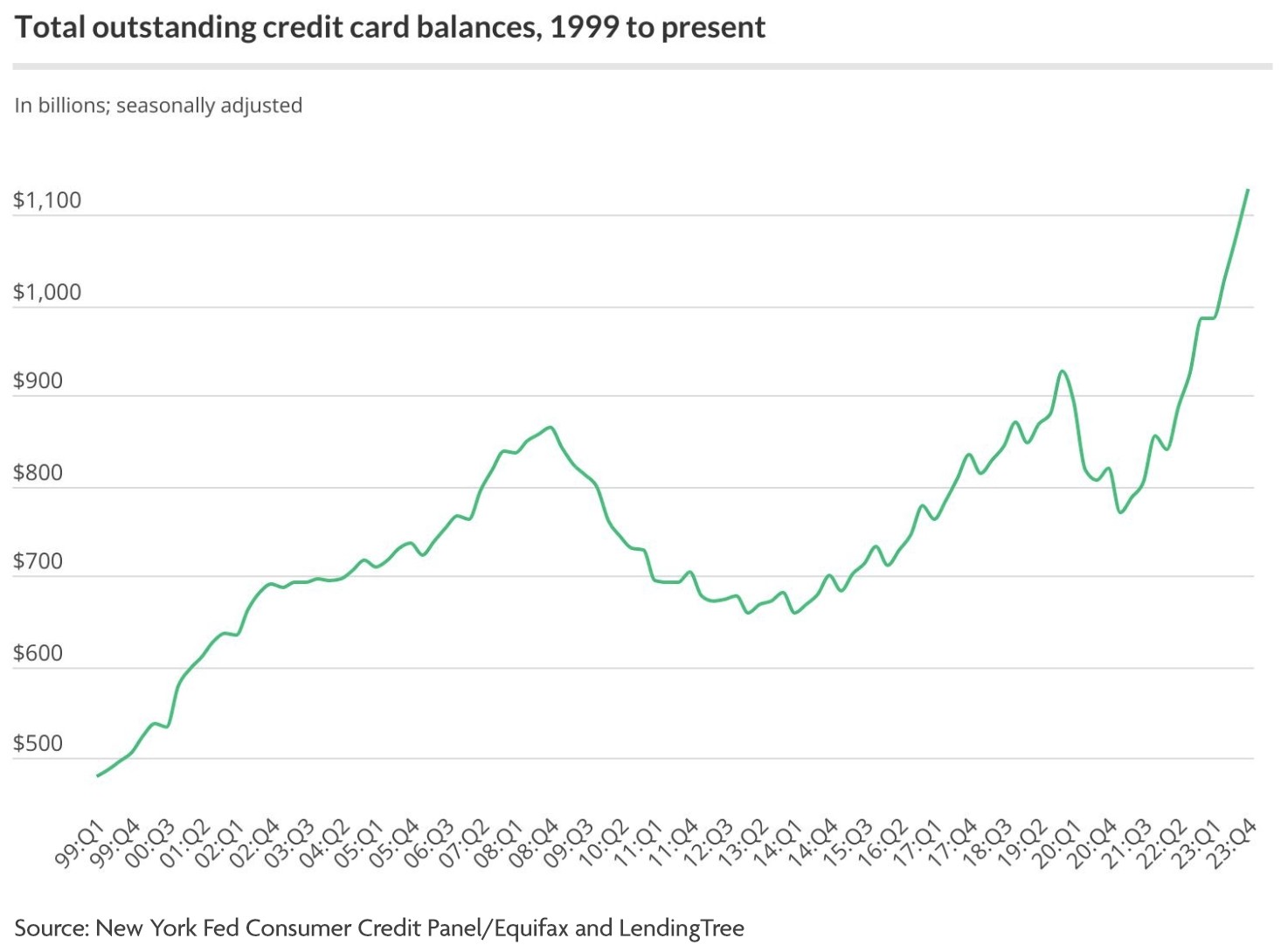

Despite the optimistic outlook on the economy frequently presented by the White House, a less positive reality unfolds for the average American – a massive surge in credit card debt. By the close of the last year, credit card debt in the United States reached a historic peak of $1.13 trillion. This alarming figure represents how Americans have had no choice but to finance basic living expenses on credit cards. Unchecked government spending has contributed to this dilemma and continues to do so, pushing U.S. citizens further into debt.s

A Nation Drowning in Credit Card Debt

A closer examination of how the nation arrived at this level of credit card debt reveals a pattern of governmental policy failures and excessive spending, among other factors, that have helped fuel a widespread cost-of-living crisis. This fiscal irresponsibility – characterized by massive spending, borrowing, and money printing – has significantly devalued the dollar, and has triggered inflation, impacting the affordability factor of Americans’ everyday purchases.

The economic impact on the average American has been severe. Reflecting on the period when the situation escalated, January 2021 to June 2022, real average weekly earnings, adjusted for inflation, declined by 5.1%. Three years into the current presidency, by January 2024, real earnings were still down. Over this timeframe, the real value of the typical American family’s weekly income experienced a decrease of $85, even though it had grown by $270.

This downturn forced a significant portion of the population to seek additional employment just to scrape by, as well as use credit cards to compensate for the decline in inflation-adjusted wages.

The Damaging Effects of Unchecked Excessive Government Spending

Higher interest rates have reacted to inflation levels not seen in four decades, stemming from unchecked government spending, among other things. This has impacted household finances by not only spurring inflation, which requires families to borrow more, but also by increasing the cost of that borrowing. Since January 2021, the federal debt has surged by approximately $6.5 trillion, reaching over $34 trillion.

Related Article: National Debt Growing by $1 Trillion Every 100 Days

Significant portions of this unchecked government spending include billions allocated to other countries to fund wars, such as the conflict in Ukraine. This diverts resources away from domestic issues such as the increasing American reliance on credit cards for basic needs. This leads to a cycle where families continually borrow money, and with rising interest rates, they find themselves stuck in a never-ending loop of debt.

Related Article: Taxpayer Fund Wars Paid Back with Crippling Inflation

High Inflation & Interest Rates Force Americans to Rely on Credit Cards

With an overwhelming majority of households living from paycheck to paycheck, many have had no choice but to fall back on credit cards for essential expenses. The situation has further deteriorated as many who initially benefited from low introductory interest rates are now facing the reality of higher balances and higher payments, which is exaggerated by the increase in interest rates we’ve been seeing.

Over the past few years, the Federal Reserve has implemented several increases to the federal funds rate in an effort to curb inflation. Such hikes in the Fed’s benchmark rate have led to higher interest rates on various financial products and loans, including credit cards. Based on statistics from the Federal Reserve, the average interest rate for accounts accruing interest reached 22.75% in the fourth quarter of 2023.

To grasp just how serious the nation’s credit card debt truly is, the following graph shows the steep increase in outstanding credit card balances that occurred over the last few years and previous years.

Credit Card Companies are Reeling in Billions

Credit card companies profit from cardholders by imposing interest charges and various fees, including those for late payments, exceeding credit limits, balance transfers, and cash advances. These companies are indifferent to the amount cardholders rack up on their cards. The reason for this is that they are well aware that substantial profits will be generated from financially strapped Americans who use their cards for essentials like groceries and bill payments.

Americans devote $240 billion annually solely to interest payments – a burden that adds to the already soaring cost of living, and lines the pockets of the credit card companies.

This may explain why the average net charge-off rate of 4.44% rose from 4.21% for the month of January, as well as 3.24% of February 2023.

In addition to this, statistics from the Federal Reserve have indicated a significant climb in credit card late payments, hitting 8.5% in Q4 of 2023. This marks a rise from 5.87% in 2022, and a further increase from 4.1% in 2021. Over two years, the rate of credit card late payments has alarmingly more than doubled.

Ultimately, the current challenge of credit card debt in America, coupled with the continued excessive government spending, has left many feeling anxious about their financial future.

What You Can Do to Protect Yourself

With inflation high and Americans drowning in credit card debt, many people are seeking out strategies that can safeguard their money from the volatile economy. For wise investors, this involves dealing in real estate, as well as precious metals like gold and silver. The rationale behind this strategy is that precious metals tend to appreciate when economic stability wavers, and the value of rental properties often climbs in response to inflation.

Related Article: How Hard Assets Create Wealth and Financial Security for Real Estate Investors

To explore the potential of building wealth and ensuring your financial stability through rental real estate investments, schedule a call with Morris Invest, or head over to our Morris Invest & SDIRA Program Overview page.

We can tailor a unique investment strategy for you that includes a cash flowing rental property that will generate a consistent income stream month after month, year after year. In today’s unstable economy, this is a smart strategy that will ensure you and your family are protected financially.

Before you go, dive into the following video for some eye-opening information – This is DEVASTATING to America’s Credit Score:

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.