In a bold move likely to spark intense debate regarding the crisis at the U.S. border, California lawmakers have put forward a controversial proposal — Assembly Bill 1840. The bill, pushed by Assemblymember Joaquin Arambula (D-Fresno), is an amendment to the “California Dream for All Shared Appreciation Loans” program. It seeks to extend the state’s zero-down, no-interest, no-monthly payment home loan program to include illegal immigrants.

If the bill goes into effect, it can set a precedent that may be adopted by additional states across the country that have similar home loan programs currently intended for U.S. citizens only. This, in turn, could effectively set the stage for the American Dream of homeownership to be stolen from actual U.S. citizens and handed over to undocumented illegal immigrants who have never paid a cent in taxes to the U.S. government.

The California Dream for All Shared Appreciation Loans Program

Launched last year, the California Dream for All Shared Appreciation Loans program provides substantial support for first-time homebuyers in the state of California. It’s managed by the California Housing Finance Agency, and as explained by the Los Angeles Times, “The loans don’t accrue interest or require monthly payments. Instead, when the mortgage is refinanced or the house is sold again, the borrower pays back the original amount of the loan plus 20% of the increase in the home’s value.”

The main amendment or revision to the program written into the bill states, “An applicant under the program shall not be disqualified solely based on the applicant’s immigration status.”

When the original program launched in 2023, it was intended for U.S. citizens, and the fund included $300 million for 2,300 applicants, and that money ran out in only 11 days. An additional $220 million has been set aside for the program in the 2023-24 State Budget.

Other changes include switching from a first-come-first-serve basis to a lottery, and the income limit has been lowered from $150,000 to $120,000. If other states follow suit, some worry that lowering the income requirement may create another housing bubble situation like the crash of 2007-2008.

As it stands, Assembly Bill 1840 is still in the legislative process, waiting for further action by the committee.

Voted into Office to Better the Lives of Americans Not Citizens of Other Countries

If politicians are able to pass the bill, American citizens hoping to take part in the program will be competing against illegal immigrants in the lottery, and it’s a given that fewer U.S. citizens will be able to buy a home because of it.

The person behind the bill, Assemblymember Joaquin Arambula, a member of the California Latino Legislative Caucus, was voted into office to serve the American people and better their lives. He wasn’t placed in office to represent citizens of other countries – this seems to be his plan, though. Referring to undocumented immigrants, he stated, “Homeownership has historically been the primary means of accumulating generational wealth in the United States.” He adds, “The social and economic benefits of homeownership should be available to everyone.”

Arambula feels American homeownership should be available to everyone. However, given the fact that American citizens have contributed to their nation’s economy from their very first day of employment, just as their parents and grandparents did before them, it stands to reason that they are entitled to this government housing support program over those who come from foreign countries illegally. This especially rings true since Americans are dealing with an affordable housing crisis that’s keeping families from being able to purchase a home.

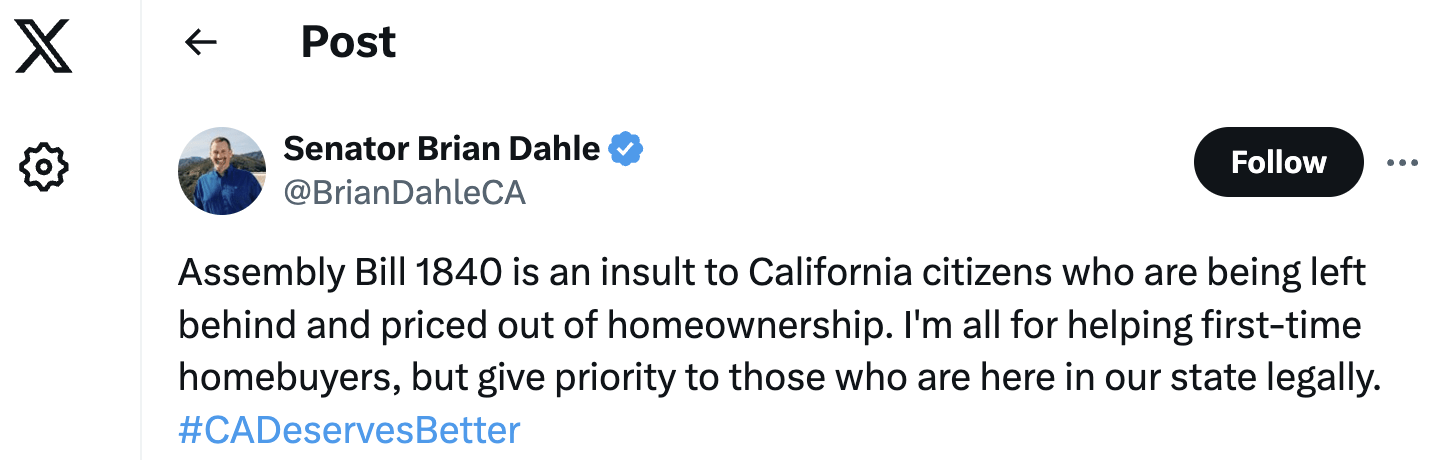

Republican State Senator Brian Dahle touched on this when he stated the following on X:

The American Dream – Politicians Want to Give it Away to Non-Documented Illegals as a Freebee

The phrase American Dream as it relates to owning a home, isn’t just a sentimental statement. No, this is an undeniable fact that matters greatly to the people of this country. Case in point, a LendingTree survey, which included 2,000 U.S. citizens, reported that:

“94% of Americans Say Owning a Home Is Part of the American Dream, but 51% Who Don’t Own Fear They Never Will.“

Regarding the American people, Mayor Bill Wells (R) of El Cajon told CBS News, “They should be first in line to buy homes and to get assistance, not people who aren’t from this country. And you know, in fact, some come from countries that our young men and women were actually fighting against. We shouldn’t move people to the front of the line who haven’t paid their dues.”

Despite common sense, the American government is feeding into the border crisis on every level, from the president to our local assembly members. Why wouldn’t the American citizens have a fair say in this? Is it because that would only get in the way of the overall plan, which may be to funnel millions of voters into the system? How much longer can our resources go toward citizens of other countries as our own country deteriorates and spirals into debt?

Related Article: A Ticking Time Bomb – National Debt Growing by $1 Trillion Every 100 Days

Safeguarding Your Wealth During These Unpredictable Times

It’s clear that the stability we once relied on as a nation is diminishing fast, and the future holds even greater unpredictability. With legislative changes potentially reshaping the landscape of homeownership in the U.S., among other things, it’s crucial to actively take steps to protect your financial health.

This can be accomplished by investing in hard assets such as real estate, which is known to be the smartest way to build and protect wealth. If this interests you, take a moment to read this piece, which goes into detail on the topic – How Hard Assets Create Wealth and Financial Security.

If you’re truly concerned about the direction the United States is going in and how it can impact your financial stability, contact Morris Invest, and we’ll help you set yourself on the path to financial independence through rental real estate.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.