Not too long after the pandemic hit, millions of workers were let go, and the troubling reality set in that being employed was not the secure option it was thought to be. However, for investors, it only confirmed that when it comes to a 9-5 job vs rental real estate, the latter offers more financial security.

I know this to be 100 percent true because during the peak of the pandemic, when hundreds of thousands of businesses were forced to scale down, with many closing up shop, my real estate investment company, Morris Invest, picked up speed to the point where I actually had to hire additional people to answer the phones.

Why did my business surge during a massive economic downturn? Why were the phone lines ringing off the hook? The simple truth is that people were scared after seeing their life’s savings drained from their 401(k) accounts, and they were worried that a 9-5 job wasn’t secure anymore after losing their day job or seeing friends and family lose theirs. The people who were calling wanted to make a safe change that would bring them financial security, and the answer was putting their funds into a tangible asset by investing in rental real estate.

With all that said, I’m going to drive home a few points on why a 9-5 job is not as financially secure as investing in real estate, so let’s get started.

The Financial Stability of a 9-5 job vs Rental Real Estate

My take on things, of course, is that real estate is the more secure option, and there are several reasons why I feel this way. For starters, in a day job scenario, the employee trades time for dollars, and there are only so many hours in a day they can work, which leaves them capped. Also, if the economy shuts down, the employee’s job is at risk. If they lose their job, the one income stream they relied on and trusted disappears.

Now, let’s break these points down a bit to get a full understanding of each:

1. When Businesses Fold in an Economic Crisis Employees are Left Stranded

When you work for an employer and an economic crisis hits, you’re at the mercy of your employer’s decisions. They may decide to let half the employees go, make pay rate cuts, or worse yet, close their doors for good.

These unexpected scenarios were in full force when the pandemic made its appearance, and this 2020 article title from the Washington Post sums up just how hard jobs were hit:

“U.S. now has 22 million unemployed, wiping out a decade of job gains”

When you’re an employee, you put yourself in a financial risk group filled with people who could lose their jobs in the blink of an eye if another massive economic downturn occurs like it did in the past.

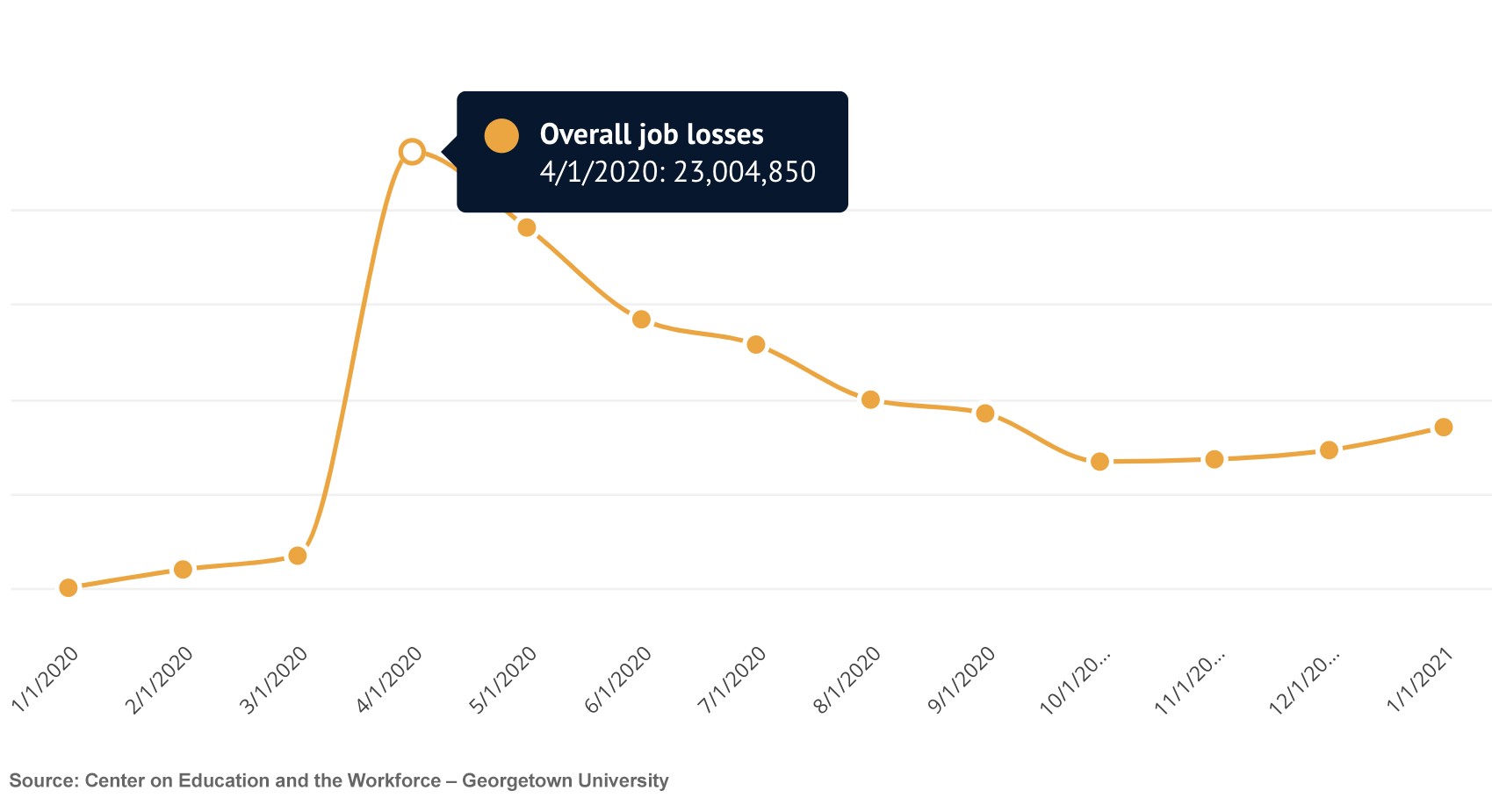

How many people lost their jobs at the height of the pandemic? It’s estimated it was around 23,004,850 people, according to Georgetown University’s unemployment tracker.

Job Losses During the Height of the Pandemic

I can’t predict if another pandemic will actually hit or not; all I can say is that I wouldn’t want to be in a situation where my financial security could be at risk if one does.

The alternative to taking a risk like this is to remove yourself from this risk group where your financial security depends on your boss, and instead, put it in your own hands. You can take back control by investing in a hard asset such as rental real estate, where no matter how bad the economy gets, your asset won’t waver, and you have control over all decisions made. For those who want to make a change by investing in real estate, you can schedule a call with one of our team members who can answer all your questions.

2. 9-5 Employees Lose 100% of Earnings if Let Go While Real Estate Investors Have Multiple Income Streams

Most employees only have one job and, therefore, have only one income stream. What if you lose that income stream due to a job loss? You apply for unemployment and once you have it, most times, it’s not even enough to cover all your bills.

When you invest in rental properties, you not only have a stable asset that brings in cash flow each month like clockwork, but you can also have multiple properties that produce multiple income streams. Make sure to dive into our article on the topic – How Investing in Multiple Rental Properties Can Create a Hedge Against Inflation & Preserve Your Wealth.

The bottom line is that a 9-5 worker will lose 100 percent of their wages if they’re let go, so it can be a financially unstable and risky situation to be in.

3. W2 Workers are Normally Financially Capped While Income is Unlimited for Real Estate Investors

9 to 5 workers who have a 40-hour workweek job know that the amount of money brought in is capped by their wage, but wouldn’t an unlimited earning potential be better?

This is what makes me choose the investment side of things when it comes to a 9-5 job vs rental real estate. I’m given the power to add as many properties as I want to my portfolio, with each of them bringing in rental income every month. Investing in real estate gives you the ability to keep building and growing until you’re financially independent and wealthy, with a substantial nest egg to retire on as well.

How to Transition Away from a 9-5 Job to Invest in Rental Real Estate

No matter what your reasons are for having an interest in rental real estate, whether you’re worried about losing your job if another economic landslide were to happen, or maybe you’d like another way of growing funds for retirement other than your 401(k) that follows the ups and downs of the economy. Regardless of your reasoning, know that it’s possible to transition away from your day job to become financially secure through real estate investing.

We’ve been helping people move over to investing in rental properties for years now. It’s what we focus on, and we’re good at it. We love helping people become financially independent on an individual basis, creating a custom plan for each person who comes to us. On top of this, we provide rental properties to our clients in recession-proof cities. Read our latest article on the topic to see how successful this has been – Lubbock Recognized as Recession-Proof City and Maintained a Strong Rental Market Throughout Pandemic.

Find Out How Many Rental Properties You Need to Leave Your Job by Using Our Freedom Cheat Sheet

You can begin by diving into our free resource, which will tell you exactly how many rental properties are needed to cover all your expenses – it’s called The Freedom Number Cheat Sheet.

It will give you a goal to work towards, and we can help you achieve that goal. We can also help you explore various funding avenues and offer multiple strategies that can assist in financing an investment property. For instance, if you have equity in your current home, you may be able to use it for the down payment of a rental property. See our article on the topic to find out if this is an option for you – Can You Use a HELOC to Invest in Rental Real Estate?

Save for a Down Payment with Connect Invest

We’ve recently partnered with a company called Connect Invest in response to numerous inquiries about how to start investing in rental properties with a smaller amount of money, all while saving for a down payment. For example, you can start investing in a real estate fund with $5,000 to $10,000, or even just $500.

Connect Invest offers an excellent starting point for those who want to get their feet wet or would like to start saving for a down payment. Some of our team members are even investing this way, and they love it. To explore this option, visit the Connect Invest site where you’ll find a video that explains how it all works.

Morris Invest Financial Resources & Programs

- Financial Freedom Academy

- The 90-Day Financial Empowerment Bootcamp

- Morris Invest & SDIRA Program Overview

Rental Real Estate is a Financially Secure Investment Vehicle that You Can Rely On

Rental real estate offers a tangible, scalable, and resilient asset class that creates multiple streams of income and provides financial security. It far exceeds a 9-5 job when it comes to keeping your money secure, and keeping your head above the water when others are sinking during economic downturns. So, as we navigate through these uncertain times, transitioning from a day job to investing in rental real estate is undoubtedly a wise move that will ensure long-term financial security and independence.

Rental real estate can be your stepping stone towards moving away from your W2 job. When you invest with us, we take care of all the details in getting you set up with a cash flowing rental property, and we even provide a tenant. All you have to do is take the first step and schedule a call with us – we certainly look forward to helping you meet your financial goals through rental real estate.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.