I’ve found from my own experience and through conversations with fellow investors that when buying or managing rental properties, understanding key rental property metrics is crucial. These metrics can provide details that reveal the financial strength of rental assets, which allows for better decision-making. Metrics such as Rentometer for rent estimates, rent rolls, and net operating income (NOI) calculations are essential tools for evaluating property performance and identifying lucrative opportunities. By understanding and utilizing these metrics, investors can maximize returns, as well as avoid investing in properties that will produce a financial loss.

In this article, I’ll cover Rentometer and answer the two rental property-related questions I’m frequently asked that pertain to real estate metrics, which are, “What is a rent roll?” and “What does NOI mean?”

I’ve incorporated these metrics into my investment strategies for years now, so I can say from experience that they’re worth becoming familiar with. That said, let’s get started…

Using Rentometer for Rent Estimates

Having a good estimate of how much rent a property can pull in is a must when it comes to making wise investment decisions. Because of this, you’ll want to utilize a trusted metric that can provide you with realistic numbers that are able to sway you away from rentals that won’t yield a good ROI or draw you into deals that are profitable. In addition to this, property managers often use rent metrics because they always need to be aware of the “going rental rates” to keep competitive, as well as not lose renters due to unrealistically high rates. That said, a good source of property metrics that estimate rental rates is Rentometer, which I’ll cover in detail next.

What is Rentometer?

Rentometer is a company that provides rent metrics and tools to analyze rentals for profitability and enables investors to see average rents by neighborhood. This all makes for a good starting point when it comes to judging a property and the surrounding neighborhood for cash flow and ROI potential, as well as how much to set rental rates for at a particular location.

One of the biggest uses for Rent O Meter is generating rent comparables, typically just referred to as “rent comps.” A rent comp is a commonly used tool to assess the fair market rent for a property by comparing it to other properties in the area that have characteristics that are comparable. Rent comps evaluate nearby properties with comparable square footage, number of bedrooms, one or two stories, and the like, all while listing their average rental rates. This information provides investors who are thinking about buying a rental property in the area with insights into its potential financial performance.

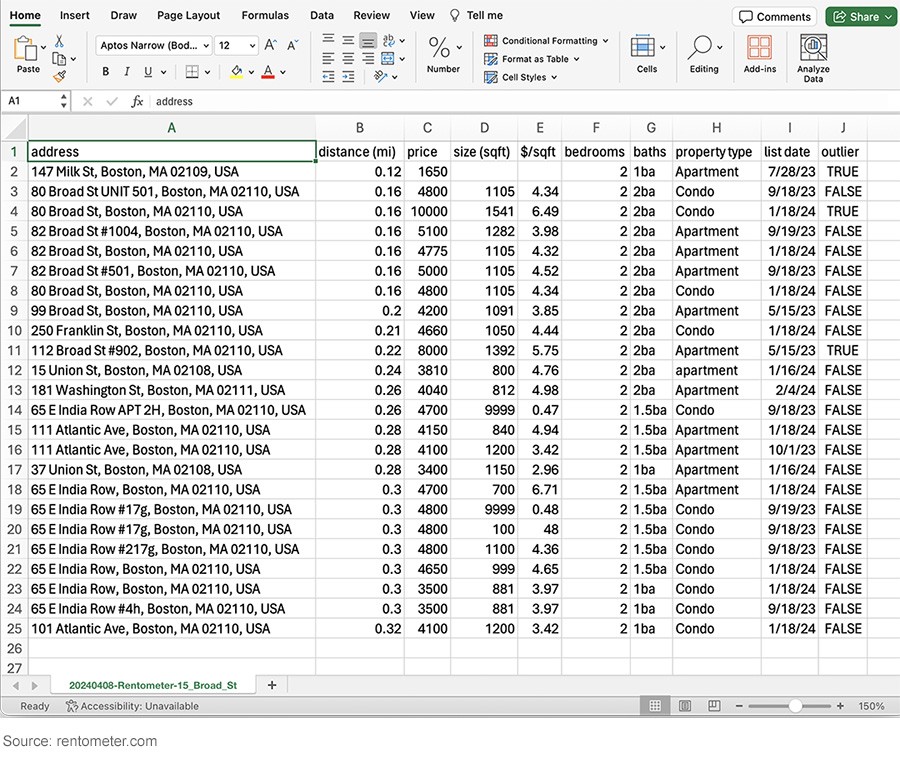

Rentometer Rent Comp Example

Here’s an example of a rent comp that Rent O Meter generates for investors researching a property. The report lays out property specs and rental rates of nearby comparable properties:

Rent O Meter also provides comprehensive rent reports that pull from public record data on a specific property. It’s really useful because without reports such as these, you’ll be going in blind and unprepared to make a sound decision on whether or not the property will generate enough rental income or not.

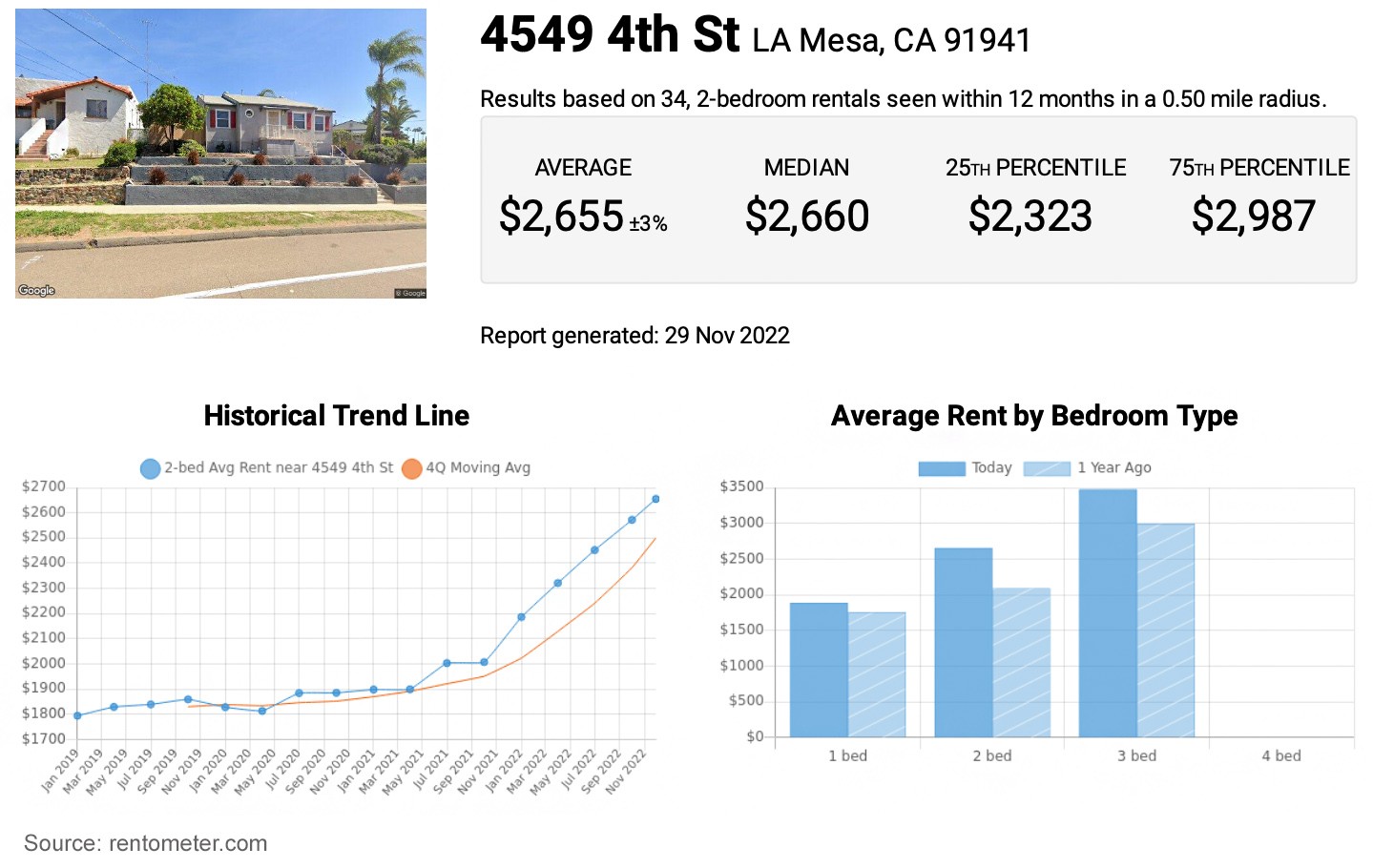

Rent O Meter Report Snapshot

Here’s a snapshot of a Rentometer report that gives investors a quick rent estimate with historical rent trends, rent by bedroom type, as well as average and medium rent for the target property:

You can sign up for a free trial with Rentometer for three days of access. I suggest doing this so you can get a feel for how the reports work and if they’re something that can help you meet your investing goals. If you find it’s providing invaluable information, upgrade to a paid plan that will give you long-term access. It’s worth the money in the long run because it can ultimately increase your profit margin.

Before we move on to the next section, be sure to dive into these posts I created on rent metrics and profitability:

- Analyzing Rent to Price Ratio: Metrics and Application

- Maximizing Rental Income: Rent Comparables & Gross Rent Multipliers

- How Much Profit Should You Make On A Rental Property?

Rent Roll and NOI: Metrics for Estimating Real Estate Investment Profitability

As mentioned, investing in real estate involves careful analysis and strategic planning to ensure profitability. Two critical components to this are a rent roll and net operating income.

A rent roll provides a detailed summary of the income generated by a rental unit, serving as a snapshot of the property’s current and potential revenue streams. This comes in handy when you own a multi-family duplex, several single-family homes, or an apartment complex. As for NOI, it offers insight into the property’s financial performance by calculating the total revenue minus operating expenses, excluding debts and taxes. Together, these metrics are essential for investors to estimate a rental’s potential return on investment.

Let’s cover these two real estate metrics in more detail:

What is a Rent Roll?

A rent roll is a document used by real estate investors that provides a comprehensive overview of income generated by rental properties. It’s also used by property managers to effectively manage rentals financially, and in doing so, keep the ROI in line for a property owner. Essentially, a rent roll is a detailed report listing all rental units within a property or portfolio, along with tenant information, lease terms, and rental rates. This report enables investors to analyze incoming rent, ensuring that they achieve their investment goals.

A well-structured rent roll will typically document the tenant’s names, lease dates, what each tenant is paying in rent, and various charges such as utilities. It may also include historical rent data, which helps investors or property managers track rent increases over time and keep an eye on market trends. Rent rolls also provide insight into tenant turnover rates and occupancy levels, which are critical metrics for maintaining profitability and avoiding potential vacancies. If you’re not up to speed on the topic of vacancies, be sure to read this article I put together – Do Vacancy Rates Matter in Real Estate Investing?

Ultimately, a rent roll assists property management companies, potential investors, as well as lenders. For investors who have a goal of optimizing their portfolios or securing funding, understanding and maintaining an accurate rent roll is essential to meeting those goals. You can view or even download a rent roll template to become more familiar with what’s included in one.

What Does NOI Mean?

Net operating income is a financial metric that measures a property’s profitability and ability to generate cash flow, and it’s calculated by subtracting a property’s operating expenses from its total income. In simple terms, it’s the funds that are remaining after your operating expenses are subtracted from your rental income.

Below, you’ll find the formula that’s used to calculate NOI:

Net Operating Income = RR – OE

(RR: Real Estate Revenue, OE: Operating Expenses)

Also, here’s an online NOI Calculator you can easily use to run your numbers.

How Rent Rolls and NOI Work Together

Investors can use a rent roll when calculating a rental property’s net operating income. How does this work? Well, a NOI is calculated by taking the total rental income from the rent roll and subtracting operating expenses such as landlord insurance, maintenance, property management fees, utilities, and so on. This figure helps investors determine whether a property can generate sufficient revenue to cover its operating costs.

As an example, if you invested in a duplex where the rent roll indicates that both tenants together produce $4,000 total a month in rent, and there are $700 a month in operating expenses that you’re responsible for, you would calculate the yearly totals ($4,000 x 12 and $700 x 12), and input them into the NOI formula, as seen below:

$39,600 (NOI) = $48,000 (revenue) – $8,400 (expenses)

A strong rent roll with consistent rental income and minimal vacancies can significantly boost a property’s NOI. Of course, the other side to this is a weak rent roll, which would consist of high vacancy rates or low rental income, and this can negatively impact the property’s net operating income. There’s no real baseline for the perfect NOI. Whether or not a calculated NOI is good or bad will all depend on each investor’s specific numbers and investment goals.

By analyzing rent rolls and calculating NOI, real estate investors can make informative decisions when it comes to buying a rental property, selling, or refinancing a rental. When you do find a property that passes these rental income metrics, you might want to consider backing that rent up with insurance. You can get more information on this in my post, Exploring Rent Guarantee Insurance, which covers it in detail.

Utilizing Rental Property Metrics for Smart Investment Decisions

Rental real estate metrics such as these are essential for a property management team to operate effectively. As for an investor, I know from my earlier, more inexperienced investing days that you should never walk into a deal blindly, and you should certainly keep an eye on your current property’s financials. In other words, an investor should always cover their bases – this includes using metrics for rent estimates from Rent O Meter or other sources, as well as using a rent roll and calculating NOI, as we discussed.

With these metrics, an investor can determine if the cost of operating a rental is greater than the estimated earnings or if there will be a worthwhile profit, as well as reveal which rental will yield the largest returns. The bottom line is that there’s a lot more to selecting a rental property than its purchase price, and these metrics provide a more in-depth or well-rounded view of a property that’s needed to make an informed decision when it comes to investing your hard-earned money.

Power Resources for Real Estate Investors

Before we come to a close, you’ll want to take some time to explore our power resources that can kickstart or enhance your investment journey:

- Freedom Number Cheat Sheet

- 90-Day Financial Empowerment Bootcamp

- Morris Invest & SDIRA Program Overview

- The Financial Freedom Academy

Additional Morris Invest Content for Future Reading

- My Personal Story on How I Left My Media Job to Invest in Real Estate

- Methods for Determining a Property’s Worth

- Exploring a HELOC for Purchasing Investment Properties

- Landlord Insurance: What Does It Cover?

- The Ultimate Guide to Residential Property Management

- Understanding Tenant Background Checks and Security Deposits

Leverage Key Rental Property Metrics Such as Rentometer, Rent Roll, and NOI to Invest Wisely

I encourage real estate investors to regularly put these essential rent estimating metric tools to good use if they have a goal of optimizing investment returns, as well as keeping property performance in check. However, after reading this article, you feel you still don’t fully grasp the answers to the questions at hand, “What is a rent roll?” and “What does NOI mean?” or you’d like to learn more about Rent O Meter, feel free to give the team at Morris Invest a call, they can provide you with the information you’ll need to get ahead of the game.

The underlying message of this article is about utilizing metric tools to ensure you invest in the right properties – rentals that perform well, have a high ROI, and provide a steady stream of income that’s higher than your operating expenses. With that in mind, for those of you who know you’re not very savvy when it comes to crunching numbers, working with metrics, or just dealing with the business side of things, know that Morris Invest can take care of everything by setting you up with a fully-done-for-you turnkey rental property.

Obtain a Profitable Rental Property from a Full-Service Real Estate Investment Company

If you’re thinking about investing in a rental property and want everything from A to Z taken care of for you, including all the metric calculations that ensure profitability, then you’ll want to book a complimentary call with Morris Invest. In the meantime, read over our post How to Easily Buy a Rental Property Before the End of the Year to get the ball rolling.

Our new construction rental properties are in lucrative locations that sport a high demand for rentals, boast booming economies, have a steady growth population, and the like. On top of this, we only build in landlord-friendly states, which protects your ROI and cash flow. In fact, we only build our rentals in locations that pass our 10-point checklist, even if it takes years for us to pinpoint the perfect area.

We also assign a professional property manager and place a tenant in each rental, so you won’t have to do all the legwork when it comes to property management and tenant screening. This ensures the cash flow begins almost immediately. If this all sounds like something you can benefit from, feel free to schedule a call with our team – we would love to provide you with an income-generating property that can greatly enhance your investment journey.

Before you go, dive into the following video that covers how to calculate the return on investment for a duplex: