If you’re a real estate investor looking for strategies to keep your ROI on the high end, then you’ll want to take advantage of property depreciation come tax time. To get an idea of how much it can lower your tax burden, you can use an online rental property depreciation calculator, or manually do the math to run the numbers yourself, and I’ll cover both options in this article.

I’m assuming that since you’re searching for direction on calculating depreciation, that you already have a general knowledge of the topic. With that in mind, I’ll just provide a quick overview for those who may need it.

The Basics of Claiming Rental Property Depreciation

Rental real estate depreciation is a strategy that enables investors to write off the wear and tear of their rental properties over time. This process is used for tax purposes, enabling landlords to reduce their taxable income by taking into account the decreasing value of their properties. According to the rules, investors can claim depreciation on their rentals over a period of 27.5 years.

This annual depreciation allows owners to offset a portion of their rental income, keeping more of it in their pocket. The reason depreciation is allowed in the first place is because the government acknowledges there’s a gradual decline in a property and its value over time. Although this is stated, most people realize that the opposite is true, that their properties actually increase in value over time, but we’ll take the tax break anyway, right?

Here’s a basic overview of rental property depreciation:

I’ve learned from personal experience that depreciation is essential, mainly because of its tax-lowering capabilities. Because of this, I’ve found that learning how to use a residential rental property depreciation calculator, manually calculating it, or at least having a basic knowledge of the process while your tax advisor takes care of the math for you, is a smart idea. I also suggest learning about other tax saving strategies, and you can do this by reading my article on the topic – Tax Shelters for Real Estate Investors.

Requirements for Property Depreciation Eligibility

Ok, now that you have a better idea of what real estate depreciation is and why it’s important, you’ll want to start crunching the numbers to determine your tax savings, maybe beginning with a rental property calculator with depreciation features. Before moving forward though, you should know that you have to ensure your property qualifies for this tax break. Below, you’ll find the main requirements, as stated by the IRS, to be able to depreciate real estate:

- The investor must own the property they’re depreciating.

- The property must be income-producing.

- It must have a determinable useful life (something that wears out, decays, etc.)

- The rental must be expected to last longer than one year.

You can get a full breakdown of the requirements and other information by heading over to this government page that contains rental property depreciation calculator IRS information.

Now, I’ll get to the reason you’re here in the first place, which is to get an idea of where you can either find a good rental property tax depreciation calculator or how to do the math yourself.

How to Calculate Rental Property Depreciation

Many seasoned investors recommend using an online depreciation of rental property calculator only for rough estimates, and relying on manual calculations, or using a specialist if you’re actually going to claim depreciation on your taxes. Let’s start with the first option:

1. Use an Online Rental Property Depreciation Calculator

I sometimes like to do a quick calculation, and to accomplish this, I use an online depreciation calculator for rental property taxes. For those of you who are interested in seeing where your numbers are at, I’m providing a few easy calculators you can try out:

- InchCalculator.com: Depreciation on Rental Property Calculator

- Calculator.net: Depreciation Rental Property Calculator

- Turbotenant.com: Depreciation Calculator for Rental Property Taxes

- Calculators.tech: Macrs Depreciation Calculator Rental Property Only

Although I’m not covering “depreciation recapture” because it typically deals in the sale of a property, head over to this page for a full overview of this subject – The investor’s guide to depreciation recapture. Also, here’s an online calculator you can check out – Rental Property Depreciation Recapture Calculator.

2. How to Calculate Rental Property Depreciation Manually

If an online depreciation calculator rental property tool doesn’t seem trustworthy enough, then you’ll want to dive into the information below to help you calculate the final numbers yourself.

First Step: Calculate the Cost Basis of Your Property

The cost basis is the total amount invested to obtain a property – the purchase price of the property (minus the land), improvements, as well as closing costs. The closing costs typically include things like escrow and home inspection fees, legal costs, fees related to the title, broker fees, as well as costs that the buyer agrees to pay on behalf of the seller, such as back taxes.

Calculating the cost basis of a turnkey rental property involves adding the purchase price to any of these acquisition costs and improvements. For example, if an investor purchased a rental home for $200,000 with closing costs that came to $5,000, and also invested $10,000 in property improvements, then the cost basis would be calculated as follows in this rough example:

Purchase Price: $200,000

Acquisition Costs: $5,000

Improvements: $10,000

Total Cost Basis: $200,000 + $5,000 + $10,000 = $215,000

In this example, the cost basis of the rental property would be $215,000.

To move forward with the next step, you’ll need to know which depreciation method to use, which should be simple if you’re a residential property owner.

Determining Your Depreciation Method

A few methods are used to determine depreciation. However, the General Depreciation System (GDS) is the method typically utilized for residential real estate, so that’s what I’ll use for this example.

The GDS is a common method under the Modified Accelerated Cost Recovery System (MACRS) for residential rental property tax depreciation calculators. When using the General Depreciation System, a property is depreciated over a 27.5-year period utilizing what’s called the straight-line method. This is when an equal amount of allowable depreciation is deducted each year over the useful life of the property (27.5 years).

This system helps landlords recover the cost of their investment through annual tax deductions, which helps with the financial burden when it comes to property wear and tear over time. To become more familiar with this, you can head over to this straight-line depreciation calculator for rental property taxes to plug in your numbers.

Second Step: Calculate Your Annual Depreciation Amount

With a cost basis of $215,000, you now simply divide that amount by the allowable useful property life of 27.5 years to arrive at the amount you can claim every year for that timeframe.

Yearly Allowable Depreciation: $215,000 ÷ 27.5 = $7,818.18

$7,818.18 is the amount you can write off each year on your taxes. Keep in mind, though, that if your property isn’t placed in service the very first month of the first year, you’ll have to prorate the amount you can claim for that year. For example, if your rental is officially in service in November of that first year, then you can only claim two months (November/December).

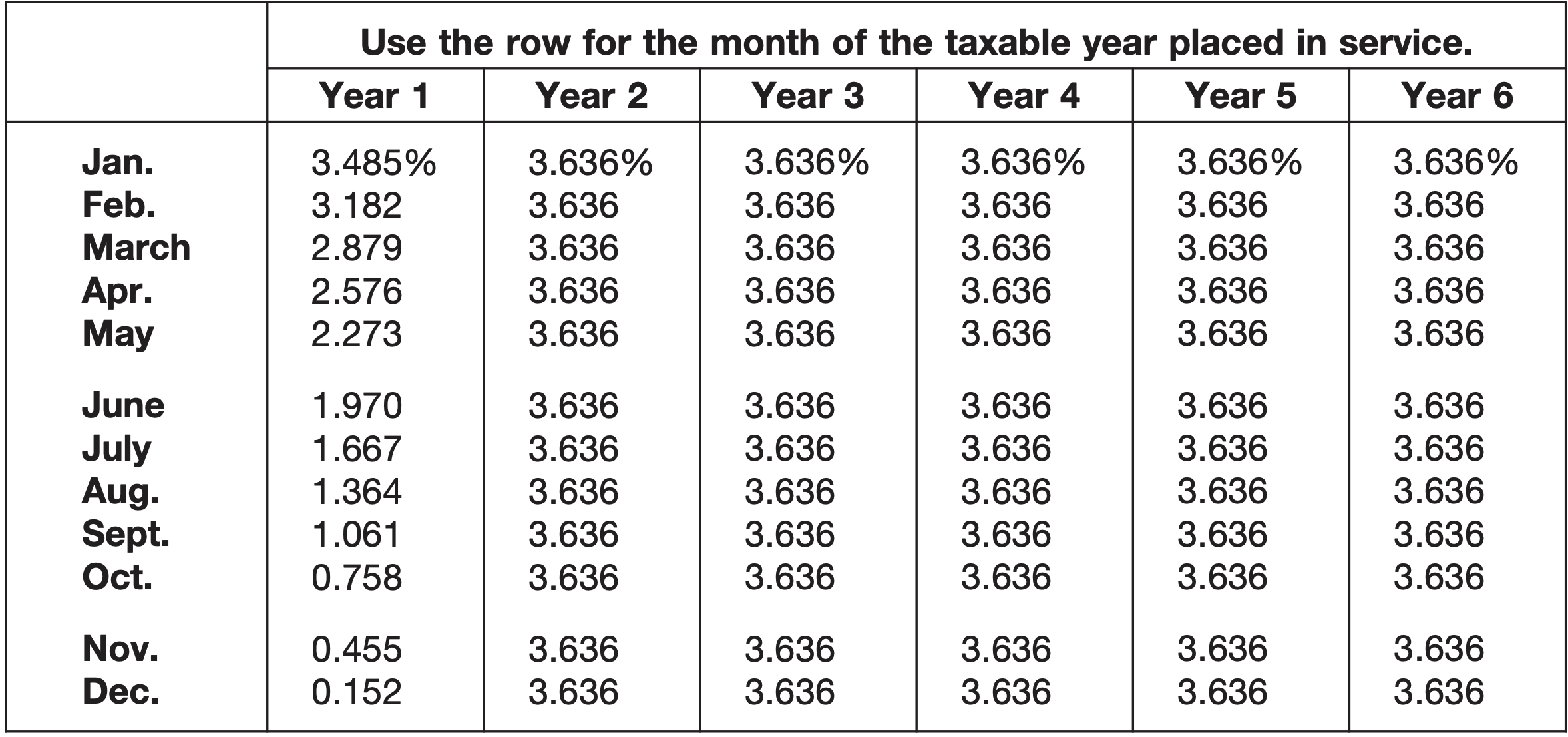

The IRS has a handy depreciation calculation table, which I included below as an example that helps you calculate your first year based on what month your property was officially placed in service.

Residential Rental Property-GDS (27.5-year S/L with mid-month convention)

Based on this table, if your property was placed in service in November, you would multiply 0.455% by your calculated cost basis of $215,000, and this would come to the amount you can write off that first year, which would be $978.25.

The final depreciation figures come to:

First Year Allowable Depreciation: $215,000 x 0.455% = $978.25

Every Year After for the Remaining 26.5 Years (as previously calculated above): $7,818.18

As you can see, utilizing a depreciation calculator rental property tool or software, manually crunching the numbers, or reaching out to your accountant is well worth it. I save thousands of dollars each year that would otherwise have been sent to the IRS if I hadn’t taken the time to put this depreciation tax strategy in place each year. The bottom line is that it allows you to hold on to more of your rental income. Along that same line of thinking, you should take a moment to read a few of my articles that contain information that, in the long run, can also help you hold on to more of your cash flow:

- Maximizing Rental Income: Understanding Rent Comparables & GRMs

- What Landlord Insurance is and the Coverage It Includes

- Safeguarding Your Investment: Tenant Background Checks & Security Deposits

- How Hiring a Residential Property Manager Can Save You Money

The best part is that I actually don’t even have to do anything to claim depreciation; I just let my tax advisor handle it. However, if you would like to tackle the job yourself but don’t have official software that allows you to easily input the data, you’ll want to place all the information in an organized spreadsheet. You can use this rental property depreciation calculator Excel spreadsheet as an example.

A Cost Segregation Study Offers Accelerated Depreciation

We covered the standard depreciation of the building as a whole, but what most people don’t realize is that there is something called a cost segregation study that allows for other elements within and around the property to be depreciated.

A cost segregation study reclassifies items such as sinks, cabinets, patios, and the like, which are the non-structural elements of the property, taking them out of the long-term 27.5 timeframe, and placing them into accelerated depreciation timeframes of 5, 7, and 15-years. This allows the investor to take advantage of the tax breaks sooner rather than later. This strategy can save the property owner thousands more early on in the life of the property.

To take advantage of the enormous depreciation tax savings a cost segregation offers, you wouldn’t be able to just use a depreciation rental property calculator. Why is this the case? Because a cost segregation is way too advanced, you would need to hire a specialist. Or purchase a new construction rental property from an investment company that includes the study.

Because Morris Invest buys in bulk when building new construction properties, we are able to offer built-in cost segregation studies with our properties. Keep in mind, if you were to hire a cost seg specialist on your own, it could cost you around $5,000 to $10,000, or more, depending on the property that’s being analyzed.

If you’d like a full overview of this topic, then be sure to dive into my article – The Power of a Cost Segregation Study. You’ll also want to bookmark the following for future reading to get ahead of the game as far as taxes are concerned – Rental Income Tax Guide for Real Estate Investors.

Lower Your Taxes with Rental Property Depreciation Calculator Strategies

If you’re just trying to learn more about the topic, then an online depreciation calculator for rental property taxes is fine. But for those who want to seriously lower their tax burden will want to hire a tax specialist to do it for them. Even if you paid someone to do the calculations for you, it’s well worth it. I personally use Tom Wheelwright, CPA, of WealthAbility, to do my taxes on all my rental properties.

Those of you who are here because you’re planning on buying a rental property and want to learn the ropes or the tricks of the trade first, like how to save thousands on your taxes through depreciation, I hope this article has increased your knowledge base. In addition to this, we can also provide you with a cash flowing new construction property that includes a cost segregation.

Working with a Full-Service Real Estate Investment Company

Our team can take care of all the details, big and small, when it comes to placing a new rental in your hands. This includes assigning an experienced property manager, as well as a tenant, so you’ll be cash flowing from the start. If this has sparked your interest, feel free to give us a call so we can get you started on the path to building wealth.

In the meantime, you’ll want to visit our power resources for real estate investors, which includes programs and resources that can increase your financial IQ and your savings:

- 90-Day Financial Empowerment Bootcamp

- Freedom Number Cheat Sheet

- The Financial Freedom Academy

- Morris Invest & SDIRA Program Overview

Before you start playing with the numbers on one of the rental property depreciation calculators I provided, take a moment to grab a cup of coffee and dive into the following video that will give you valuable information on how to avoid paying taxes as a real estate investor: