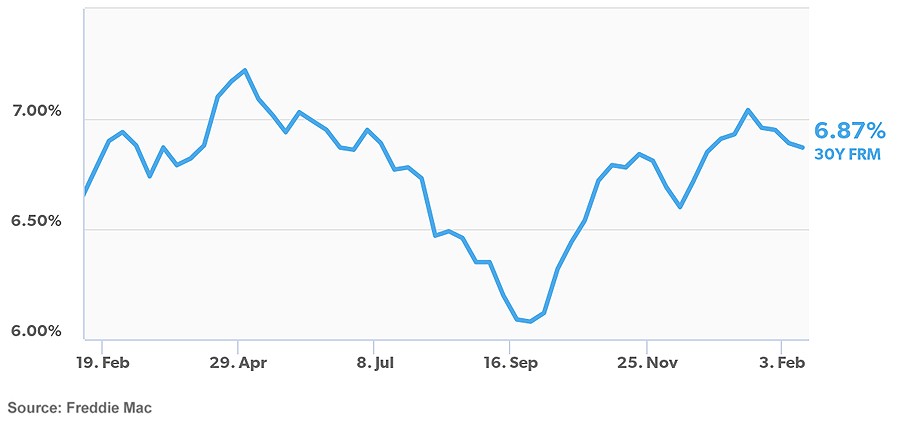

For a fourth straight week, mortgage rates dipped slightly to 6.87% on a 30-year fixed-rate mortgage. Weaker-than-expected retail sales data drove the 10-year Treasury yield lower, which may be responsible for this push below 7%. The rate drop has given prospective buyers some hope as the spring homebuying season approaches. However, while the market welcomed this decline, and some hopes are high, rates are still elevated and unaffordable home prices still exist.

Additionally, many are unsure of what lies ahead within the housing sector. Lisa Sturtevant, chief economist at Bright MLS, touches on this by stating, “Mortgage rates could be volatile in the weeks ahead, which could set us up for an unpredictable spring housing market.”

U.S. weekly averages as of 02/13/2025

Lowest Mortgage Rates Since December Fail to Spark Significant Market Movement

Despite the higher-than-desired levels, the small but steady declines have improved conditions somewhat, bringing them down to a low not seen since December 2024. Although the small dip in rates is not making a big impact on the market, it is drawing some buyers back in and motivating sellers, as well as drumming up an 11% boost in new listings.

Borrowers are also taking action while rates continue to trend downward, as noted by Nerd Wallet’s home and mortgage expert, Holden Lewis: “Mortgage rates have fallen four weeks in a row, but so gradually that you would think that scarcely any borrower would notice. But borrowers who bought homes in fall 2023, when rates were well above 7%, have paid attention; we’re seeing a mild surge in refinances.”

This surge was reflected in statements made by the Mortgage Bankers Association (MBA), where it was reported that refinance applications rose 10% week over week and were 33% higher than this time one year ago.

Outlook for the Spring Housing Market

Even with mortgage rates dipping, most buyers and sellers are not gearing up to take part in the upcoming spring housing market activity. Rates are just not moving enough, home prices are still unaffordable, and overall inflation is draining the average American’s pockets. When families are struggling to keep up with high grocery and gas bills, taking on a large mortgage just seems out of reach.

According to a statement by Joel Kan, vice president and deputy chief economist at the MBA, home prices are continuing to rise: “The average loan size for a purchase loan has increased since the start of the year and continued that trend last week with weaker government purchase activity, which reached $447,300, the highest level since October 2024.”

Related Article: American Dream CRUSHED – Housing Survey Reports Renters’ Hopes of Owning a Home Sinks to Historic Low

It’s clear that these high rates and skyrocketing home prices have caused a lag in buyer activity. Just last month, the average time it took to sell a home was 54 days, which is the longest period since spring of 2020. That said, with the spring homebuying season only five weeks from now, market analysts are not predicting a big boost in activity.

Rentals May Be in High Demand this Spring as Buyers Wait Out Market Volatility

With the spring housing season not predicted to be in full swing this year, it brings to light the fact that many individuals and their families will be settling into rental properties. Living the American dream in a rental home offers a much easier entry point and won’t break the bank at a time when mortgage rates and prices across the board are unmanageable.

The opposite is true for real estate investors, though, because they’re not waiting to buy a property. Why? Because it will be to their advantage to purchase a rental now as more held-back buyers seek out single-family homes to rent.

At this point, renting is the new trend for those who gave up their dream of buying a home. At the same time, these tenants are finding that renting instead of buying actually provides big financial advantages, care-free maintenance, and the freedom to just move when needed. Because of this, real estate investors would be wise to buy now, even with rates elevated.

In reality, the mortgage rate shouldn’t be a big concern because investors can always refinance when rates lower. The focus should be jumping into the market when demand is high to get a head start when it comes to generating wealth because time in the market is more important than timing the market.

Related Article: Jumpstart Your Wealth: Financial Benefits of Investing in a Rental Property Sooner Rather Than Later

Invest in a Rental Property Now and Refinance Later

If you’d like to take advantage of the current market conditions that offer a high demand for rentals along with high rental rates, you’d be wise to consider utilizing a full-service investment company that can take care of all the details, enabling you to push a property purchase through quickly.

Morris Invest offers new construction properties, and a tenant is actually placed for you, along with a property manager. This allows investors to gain a lucrative rental property that starts cash flowing from the start. If you’d like to speak to someone to learn how this would all work, feel free to schedule a complimentary 30-minute call. In the meantime, head over to our Morris Invest & SDIRA Program Overview page to find out what we can do to enhance your investment journey.

Before you go, dive into the following video – Secure Your Future in a Turbulent Economy: