This might sound a bit intimidating, but it shouldn’t because once you learn what these disallowable transactions and rules are, you will be well-informed, and that will give you the ability to invest with confidence. With that in mind, let’s dive in so you can learn how to properly utilize your self directed individual retirement account to properly hold your investments.

What is a Self Directed IRA?

An SDIRA is an alternative option to the traditional IRA that provides an individual with a larger variety of investment options, as opposed to being confined to such investments as stocks and bonds, which can decrease in value whenever the stock market is on a downward trend. In comparison, a self directed IRA may be used to purchase lucrative and financially sound investments such as real estate. Utilizing an SDIRA where you have control over your funds, and your investments, is a wise choice for those seeking financial independence.

Take a moment to review our article on why switching from a traditional to a self directed IRA is a smart strategy for growing your retirement funds. Additionally, you won’t want to miss the following video that talks about the power of an SDIRA for building wealth.

What are Self Directed IRA Prohibited Transactions and Rules?

A prohibited transaction, rule, or regulation pertaining to a self directed IRA are strict guidelines set forth by the IRS to avoid the improper use of a retirement account. This generally pertains to selling, leasing, or exchanging an investment to or with a disqualified person, including yourself, or actions that benefit a disqualified person. If an SDIRA holder engages in a prohibited transaction, or breaks other various rules, costly consequences may occur.

Now that you have an understanding of some basics, let’s take a look at a few self directed IRA transactions that are not allowed, as well as some general SDIRA rules.

1. Prohibited Transactions with Disqualified Persons

Self Directed IRA prohibited transactions include certain actions that take place between an SDIRA and a disqualified person. The most common transactions with disqualified persons that should be avoided are lending money or space, selling and leasing property, as well as exchanging or borrowing. Extending credit is also not allowed, transferring income or the investment itself, and providing goods and services.

Who is a Disqualified Person?

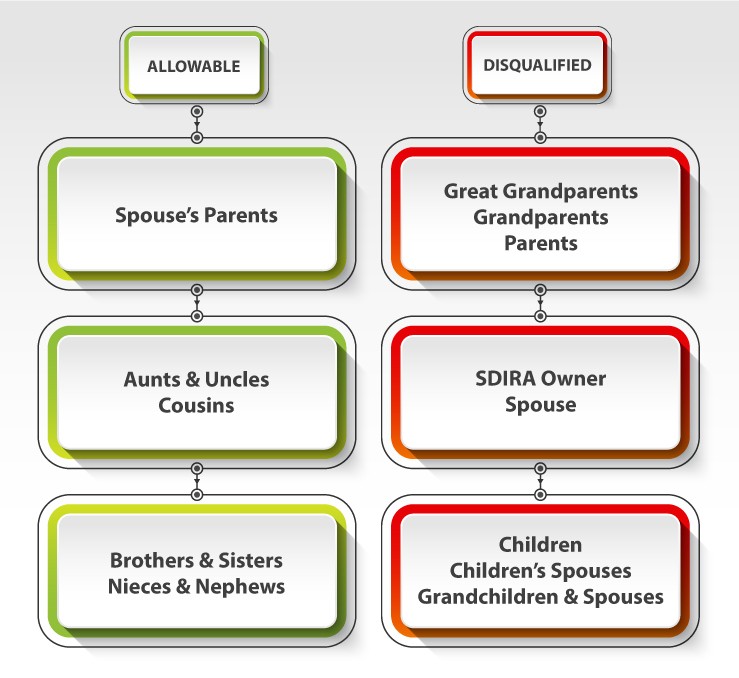

Those considered to be disqualified are lineal ascendants and descendants of the SDIRA holder. Those relatives who have proceeded the account holder in his or her direct lineage are referred to as ascendants – parents, grandparents, and great grandparents.

Relatives who precede them are called descendants – children, grandchildren, and so on. In addition to this, the account holder would also be disqualified, as well as their spouse, and the retirement account owner’s employer, and any fiduciaries, such as financial advisors, account managers, lawyers, and the like.

Below you will find a chart that details which intermediate and extended family members are disqualified, and which are not:

2. Must Not Benefit Directly or Indirectly

No actions can take place that directly or indirectly benefit the SDIRA holder or any disqualified persons. One reason this rule was created was to avoid allowing a disqualified person to benefit financially, or in other ways, from the retirement account before retirement begins – only the self directed IRA should benefit.

Below you will find a few examples of SDIRA direct or indirect benefits that you should avoid:

- A portion of the property held under an SDIRA, such as a garage, is being used to store items by the account holder or other disqualified persons.

- The account holder allows a disqualified individual, such as a child or parent to stay on the property.

- Commingling takes place, such as mixing SDIRA funds with non-SDIRA funds.

- Using self directed IRA owned assets as collateral for a loan.

- A disqualified individual becomes an employee of an LLC that’s holding an SDIRA, where income or commissions are earned.

3. Sweat Equity is Not Allowed with SDIRA Investments

If an investor owns a property that’s held within a self directed IRA, the IRS prohibits them from performing what is called sweat equity, which is a non-monetary contribution. This can include actions such as fixing up or performing work on a property, and the work is performed by the account holder, or another disqualified person.

One reason this rule is in place is to prevent the account holder from saving money by doing the work themselves, which would be a benefit to him or her. Essentially, the self directed IRA itself must hire and pay someone to do the work.

4. The Property Title Should Not Be in the Owner’s Name

If an investor purchases rental real estate through a self directed IRA, it’s against the rules to place the property title in the investor’s name. This is because the investor and the SDIRA are separate entities. This also means that all paperwork must be completed in such a way that is clear that the self directed IRA holds the title.

5. Certain Investment Types are Prohibited

Although a self directed IRA provides a broad spectrum of investment assets to choose from, there are, however, a few SDIRA prohibited investments to be aware of. This would include life insurance policies, collectibles, as well as S-Corporations.

Because there are more than a few collectibles out there, you might find the following table helpful. It contains some examples of collectibles that are prohibited, as well as a shortlist of SDIRA allowable investments.

| SDIRA Prohibited Collectables | SDIRA Allowable Investments |

|---|---|

| Antiques | Real Estate |

| Gems | Cryptocurrencies |

| Stamps | Precious Metals |

| Rugs | Oil & Gas |

| Most Metals | Race Horses |

| Most Coins | Tax Liens |

| Artwork | Raw Land |

| Certain Alcohol | Coffee |

| Other Tangible Property | Promissory Notes |

| Baseball Cards | LLC Memberships |

| Comic Books | Start-Up Businesses |

| And More | And More |

6. Expenses Must be Paid from the SDIRA

When rental real estate is held within a self directed individual retirement account, it’s prohibited for the owner or another disqualified person to pay for repairs, or anything else out of their own pocket. Instead, all expenses must be paid directly from the SDIRA. Examples of expenses might be repairs, renovations, HOA fees, taxes, property manager fees, insurance, and the like.

7. Investment Income Should be Deposited into the Self Directed Individual Retirement Account

All investment income, such as monthly rent checks from a property that sits within an SDIRA, will need to be deposited into the retirement account. Additionally, the rent checks are not allowed to be written out to the SDIRA owner. They would need to be made out to the self directed individual retirement account itself by having a contract between the tenant and the SDIRA, or to an assigned property manager who then deposits the checks into the retirement account. Additionally, if the SDIRA sits within an LLC, the checks can be written out to the entity.

8. Early Distributions are Not Allowed

The system is set up to discourage account holders from using their retirement funds before reaching the designated age of 59 1/2. In normal circumstances, if an investor withdraws funds from their account before this time, they will be subjected to penalties set forth by the IRS.

What Happens if You Break Self Directed IRA Prohibited Transactions or Other Rules?

As a smart investor, you will want to play by the rules so you won’t suffer the consequences and end up losing money. Below you will find a few penalties that can keep investors in-line:

1. Consequences of Engaging in Self Directed IRA Prohibited Transactions

For those that do move forward with a prohibited transaction during a specific year, such as those listed above regarding transactions between an SDIRA and a disqualified person, the penalty is that their SDIRA will no longer be deemed an IRA, and this reclassification would be backdated to the first day of that calendar year.

This would have a negative financial impact on an investor because it means the assets within the SDIRA are recognized as being distributed to the retirement account owner. When this happens, if the value of those assets exceeds the cost basis, then a taxable gain will occur for the year. On top of that, if the account holder is not yet 59 1/2 years of age, then an early distribution penalty will apply.

2. Improper Property Title Assignment Tax Ramifications

Investors who accidentally place a rental property title in their name, and not in the name of the SDIRA, will have to deal with the IRS viewing the situation as the investor owning the property, instead of the SDIRA owning it. As a result, the special IRA tax treatments the investors would typically enjoy, wouldn’t apply. This would not be a favorable situation come tax time, as the investor would have to pay taxes on the income generated from the rental property.

3. Penalty for Investing in Collectibles

A self directed IRA that holds a disallowed collectible will be penalized by having that asset viewed as being distributed during the tax year it was acquired. The investor will then have to pay taxes on the collectible, and an early distribution penalty of 10 percent will also apply, if applicable.

4. Early SDIRA Distribution Penalties

When funds are withdrawn early from a self directed individual retirement account, the investor will be required to pay a 10 percent penalty on the amount that was withdrawn. In addition to this, the amount that was taken out will also be included in their gross income and taxed in the year it was withdrawn.

There are some cases when the penalties are not applied; take a look at this page from the IRS titled Exceptions to Tax on Early Distributions for more information. Additionally, if you had early distributions during the coronavirus pandemic, you may be eligible for a tax break that waives the 10 percent penalty. You can find more information on the IRS website on their Coronavirus-Related Relief for Retirement Plans and IRAs page.

Whether or not you are penalized for breaking a self directed IRA prohibited transaction or not, you should have a good tax consultant on your side. We use Tom Wheelwright of WealthAbility, and recommend him to all our clients.

A Full-Service Real Estate Company Can Help You Properly Invest with Your SDIRA

If you would like to protect and maximize your funds by investing with your retirement account without accidentally engaging in a self directed IRA prohibited transaction, then working with a full-service investment company is the best path to take.

At Morris Invest, we take care of all the details for you, getting you set up with a cash flowing rental property that sits within your self directed IRA. We can even set your SDIRA up for you if you currently have a traditional IRA.

Our team does all the market research to locate a property that sits within a lucrative rental market, as well as assigns an experienced property manager, and a carefully vetted tenant. The bottom line is that our rental properties are fully renovated and ready to go, and we ensure everything is in order with your self directed individual retirement account.

Consider Placing Your SDIRA Within an LLC

For incredible tax benefits, as well as asset protection, you may want to look into placing your self directed IRA within an LLC. If you would like to learn more about this, which we highly recommend you do, contact Scott Smith with Royal Legal Solutions, or you can inquire with Corporate Direct. Either company can answer your questions, as well as assist you in getting set up with an entity.

Also, take a moment to view our article – Can You Use a Self Directed IRA to Purchase Real Estate? It goes over some important details that may be useful to you.

Additional Articles by Morris Invest

As a property investor, you should be well informed on many related topics. With that in mind, below you will find a few of our top articles that will help you become a successful investor:

- Dive into our capital gains tax guide for some essential information.

- Get important details on equity that will help you financially.

- Check out our rental income tax guide for some outstanding tips.

- Every property investor should know how to value real estate.

- Learn the ins and outs of cash flow within this informational article.

- If you need more funds to purchase a rental property, you can buy with multiple investors!

- Do you have an estate plan? If not, find out if you need one.

- Which is right for you as an investor – stocks or real estate?

- Try the BRRRR method, it can increase your net worth and your rental portfolio.

If you need additional money to fund a real estate deal, we suggest reading over our personal Fund & Grow review page, or go directly to our Investment Funding page where you can request more information on Fund & Grow.

Invest Without Breaking the SDIRA Rules or Engaging in Prohibited Transactions

As a full-service real estate investment company, we look forward to meeting with each and every investor to learn what their goals and dreams are. Our team is here to help you purchase your first rental property, or increase your current portfolio with a cash flowing rental property.

We have helped many individuals use their SDIRA to start investing in real estate, and ensure all IRS guidelines are adhered to, such as avoiding self directed IRA prohibited transactions. You can easily schedule a phone call with a Morris Invest team member so we can help you build wealth the right way. Additionally, you can read more about our entire team, and what we can do for you as a rental real estate investor by visiting our Morris Invest & SDIRA Wealth team page.

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.