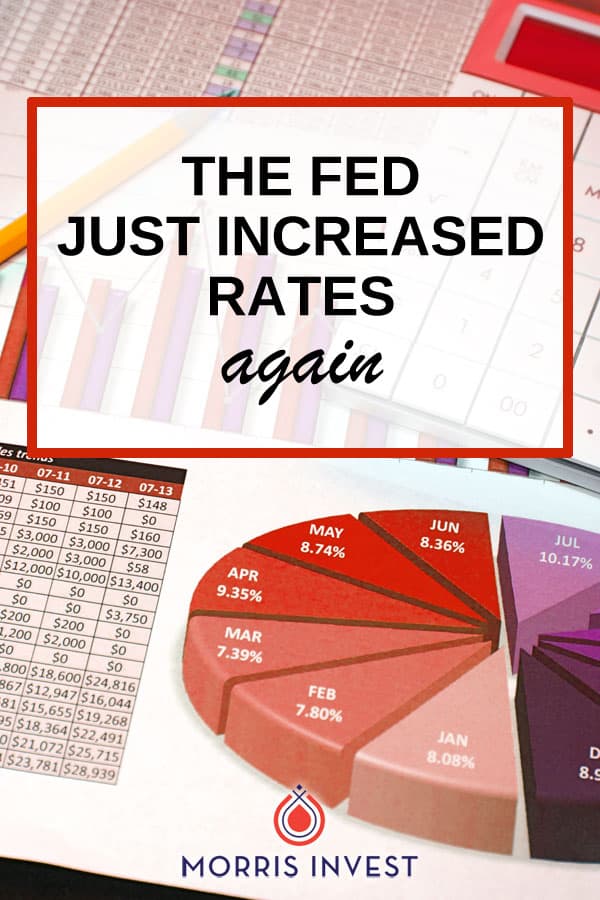

EP132: The Fed Just Increased Rates Again

Book a call with our team: https://go.oncehub.com/morrisinvest/?utm_source=MIblog&utm_medium=MIBlog&utm_campaign=MIblog&Source=MIblog

This episode is brought to you by VTech. VTech’s new Small Business Phone System is the most affordable and easy 4-line phone system on the market. The VTech 4-Line Small Business Phone System components are available at Office Depot, Office Max, Staples, and vtechphones.com.

The Federal Reserve just announced yet another raise in interest rates. Higher rates will make purchasing homes harder and more expensive for homebuyers, but what does this mean for real estate investors?

On this episode of Investing in Real Estate, I’m discussing the three main ways that an interest rate hike directly influences real estate prices. I’ll share how to analyze how the rate will affect your purchases, and how investors can prepare for the future. Don’t miss it!

More About This Show

If you’re planning to purchase your real estate investments with a conventional mortgage, this newly increased interest rate could be an issue. Your ROI will immediately decrease if you’re paying more for a mortgage. That’s why cash is king; if you’re paying with cash, you’ll be unaffected by interest rates.

Additionally, banks aren’t as likely to lend when the rates are up. Usually, banks trade money around, but when rates rise their cash flow is more restricted. As an investor, this is your opportunity to swoop in with cash on hand to purchase properties that people are unable to get mortgages for.

Another reason why interest rates affect real estate prices are the basic valuation fundamentals. It changes how much you pay for everything, not just the mortgage.

The underlying theme for investors is: cash is critical in this economic climate! As an investor, if you’re able to pay for your properties with cash, you won’t have to worry about mortgages. That’s exactly what Harry Dent predicted in our interview late last year.

It’s going to become increasingly difficult for new homebuyers to acquire traditional mortgages. Not that we want to champion others’ misfortunes, but as investors there will be an opportunity to purchase homes that others are unable to qualify for IF you have cash on hand.

On today’s show, I’ll dive more deeply into the importance of mortgage rates. I’ll talk about the overall implications on the economy, and why cash is so important for investors. Don’t miss episode 132!

If you’re ready to begin building a passive income through rental real estate, book a FREE call with our team today. We’re ready to talk about your goals and want to help you learn more about earning legacy wealth for you and your family.

On this episode you’ll learn:

- How can you determine how the rising rate will influence real estate prices?

- What is a discount rate?

- What qualifies as “cash?”

- Why are first time homebuyers being squeezed out of the market?

- And much more!

Episode Resources

VTech

Subscribe to Investing in Real Estate on iTunes

Find Your Financial Freedom Number

Subscribe to the Morris Invest YouTube channel

Like Morris Invest on Facebook

EP215: How to Find Discounted Properties – Interview with Brent Daniels

Ready To Build Passive Income Through Rental Real Estate?

Ready to talk about your goals? We're here to show you the tools and teach you the process to begin earning legacy wealth for you and your family.